Tax benefits for investment projects in the Far East

Pepeliaev Group advises of two federal laws that are extending regional investment tax benefits1.

What has changed?

What has happened?

On 30 September 2013 Federal Law No. 267-FZ (the “Law No. 267-FZ”) came into force. Law No. 267-FZ has established tax benefits for regional investment projects.

A Regional Investment Project (“RP”) is a project that is implemented in the Far East and Eastern Siberia regions and that meets a number of conditions, in particular, a specific volume of capital investments2 and the type of activity3 (an “Initial RP”).

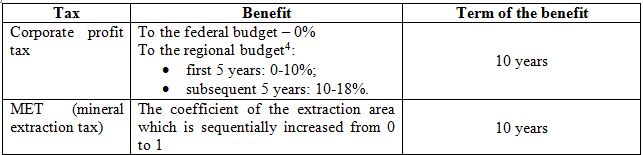

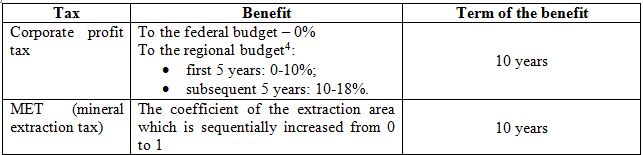

The benefits established by the law in question are reflected in the table:

However, practice has identified a number of problems preventing this investment regime from spreading:

- it is hard to obtain the status (for example, when filing an application to obtain RP status, an applicant is required to own a land plot (either have ownership title or a long-term lease) on which it plans to implement the project);

- there is a risk of the taxes and levies (profit tax and MET) that are saved being additionally assessed if a participant loses RP status, including based on the results of a tax audit;

- the land plot chosen for implementing the RP should be free from other real estate belonging to persons other than the investor;

- the project initiator should have a construction permit when filing the request to obtain the status of a RP participant.

Federal Law No. 144-FZ dated 23 May 2016 (the “Law No. 144-FZ”) has established a new type of RP. In this regard, it is possible to distinguish the following types of RP:

1. Initial RPs;

2. Investment projects that are already being implemented in the Far East and Eastern Siberia Regions (“Active RPs”);

3. Projects in the area of industrial production (“Industrial RPs”) implemented in all areas of Russia.

A new regulation procedure provides for different benefits for these types of RP.

Initial RP

Participants of these RPs have a new tax benefit – the regional profit tax rate is reduced to 10% for the payback period for capital investments in the implementation of the RP5.

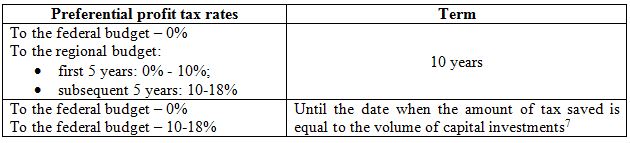

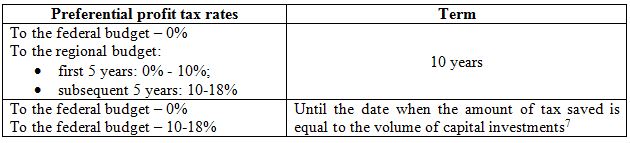

The time period6 for which the benefits are applied differs depending on the chosen procedure for applying preferential tax rates; please see the table below.

Law No. 144-FZ has not changed the benefit in relation to MET.

PG comments: The above amendments are aimed at rescuing the institution of regional investment projects and at making it more attractive for investors. However, despite eliminating almost all the problematic provisions of Law No. 267-FZ listed above, the provision has been retained regarding additional assessment of profit tax for the whole period during which an investment project is implemented if the declared volume of capital investments has not been reached.

Active RP

The participants of these RPs can be investors who invested capital in the amount of:

- RUB 50 million within a period not exceeding 3 years from the date when the first capital investment was made, but not earlier than 1 January 2013, and not earlier than 3 years before the company applied for the benefits;

- RUB 500 million, provided that the capital investments are made within a period not exceeding five years from the date when the first capital investment was made, but not earlier than 1 January 2013, and not earlier than five years before the company applied for the benefits.

The profit tax and MET benefits applied to active RP participants are in general similar to the benefits described above with regard to initial RP participants, except for the following specific features:

- the procedure for obtaining the status of an RP participant (a declarative procedure, also no need to be added to the register, after the project starts to be implemented);

- there is no opportunity to choose the procedure for applying the preferential tax rates (it is impossible to apply the preferential rates based on the payback of capital investments);

- the duration of benefits for capital investments of RUB 50-500 million – 1 January 2029 for projects with capital investments exceeding RUB 500 million – 1 January 2031;

- the constituent entities of the Russian Federation have no right to increase the minimum volume of capital investments, and to add other requirements to those that are already established.

PG comments: Introducing this category is aimed at creating equal conditions for the participants of projects are already being implemented in a region and will have the same economic effect as Initial RPs.

Industrial RP

This type of RP is established for the purpose of implementing Federal Law No. 488-FZ “On industrial policy in the Russian Federation” dated 31 December 2014.

Applying this type of RP is based on entering into a special investment contract (a “SIC”) according to the procedure provided for this Federal Law.

MET benefits are not applied to this category of RP participants.

The main specific features of applying profit tax benefits for this type of RP are as follows:

- the list of investment projects is determined pursuant to the Federal Law “On industrial policy”;

- a constituent entity of the Russian Federation has a right to reduce the regional tax rate to 0% (at the same time, the tax rate payable to the federal budget is 0%) for the period until the SIC expires, but not later than 2025 inclusive;

- a special deprecation coefficient (not exceeding 2) is applied to depreciable fixed assets included in deprecation groups 1-7 when such assets are produced in accordance with terms and conditions of a special investment contract;

- there is a separate stipulation regarding stabilisation of the taxation regime for the period when a special investment contract is implemented.

In addition

Pursuant to Federal Law No. 252-FZ:

- the Russian Government has an opportunity to create areas of advanced social and economic development (often referred to as “priority development areas” (PDAs)) on the territories of municipal units where there is a single dominant employer (so called “monocities”) in which there are risks of a deterioration in the social and economic situation, as well as in monocities with a stable social and economic situation that are included in a list to be established by the Russian Government. Such PDAs can be created starting from as early as 1 January 2017;

- a preferential regime for business operations provided for by the law “On the free port of Vladivostok” (FPV), except for controlling the entrance of persons, vehicles, cargo, goods and animals in crossing points, covers a number of municipal units outside the Primorie Territory. Namely, this law covers Petropavlovsk-Kamchatskiy and Vanino (Khabarovsk Territory), as well as the city districts of Korsakov (Sakhalin Region) and Pevek (Chukotka Autonomous District).

Help from your advisers

Pepeliaev Group's lawyers are ready to provide full-fledged legal support, including in obtaining the status of an RP participant or a PDA and FVP resident; assisting in entering into an SIC or an agreement with a management company; and assisting in interacting with tax and other supervisory authorities, and providing other legal services in the course of production activity.

We will keep you posted about the development of legislation aimed at stimulating investment activity in the Far East and other Russian regions.

-----------

1. Federal Law No. 144-FZ dated 23 May 2016 “On amending parts one and two of the Russian Tax Code” came in force on 23 June 2016 except for certain provisions and Federal Law No. 252-FZ dated 3 July 2016 “On amending the Federal Law ‘On areas of advanced social and economic growth in the Russian Federation’” and the Federal Law “On the free port of Vladivostok” came in force on 4 July 2016.

2. In the amount of RUB 50 million within 3 years after RP status is received, or in the amount of RUB 500 million within 5 years after RP status is received. A law of a constituent entity of the Russian Federation may increase the minimum volume of capital investments, and it may also establish other requirements in addition to those established by the Russian Tax Code.

3. RPs cover production projects not aimed at extracting hydrocarbons, refining oil and transporting it, producing excise goods (except for cars and motorcycles) and carrying out activity to which 0% profit tax rate is applied.

4. To the regional extent, the precise profit tax rate is established by the laws of constituent entities of the Russian Federation, but within the limits established by the Russian Tax Code.

5. The right to choose the procedure for applying benefits in this case is provided to the taxpayer. The information regarding which procedure for applying tax rates has been chosen is specified in the application to include the RP participants in the register.

6. The duration of the preferential tax rates depends on the volume of capital investments.

7. The laws of constituent entities of the Russian Federation can shorten the time period for which the reduced tax rate is applied for all or for certain categories of participants.