The UAE Tax Case Study. Foreign Investment Fund: tax treatment in the UAE

The scope

The scope of this research is focused on:

- foreign investment funds which are treated as a partnership in their jurisdictions, and

- foreign profit sharing agreements whereby one partner holds investments in foreign jurisdictions on behalf of himself and other partners.

We consider investment funds focused on investments in securities and funds investing directly in real estate or related non-securitized investments.

A contribution to an investment fund provides an investor with the fund’s shares, membership units, partner interests, etc. The purpose of this research is to determine:

- whether income paid to the investors may qualify for the participation exemption and the 0% Corporate Tax rate, or an underlying investment of the fund shall be tested,

- specifics for the taxation of such income in the UAE,

- specifics for applying a foreign tax credit in the UAE for incomes which have failed to pass Participation Exemption and Qualifying Activity tests.

Introduction

1. Investors from the UAE are entitled to the:

- Participation exemption regardless of where they located.

- 0% rate if they are located in a free zone for any income triggered by the holding.

Dividends from UAE residents are exempted unconditionally. Article 22(1) of the Corporate Tax Law.

2. The requirements for the participation exemption are tougher. Therefore, income qualifying for a participation exemption will most probably qualify for the 0% Corporate Tax rate in a Free Zone.

However, the Participation Exemption is relevant for Free Zone companies because the qualification of income is not enough to enjoy the 0% tax rate. The zero rate position is vulnerable as:

- non-compliance with TP regulation for any transaction creates a deprivation of the 0% rate for all transactions for 5 years, and

- the adequate substance requirement has a high level of uncertainty. Lack of adequacy has same effect – depriva-tion of the 0% rate for 5 years.

Therefore, both (the participation exemption and qualification for the 0% rate) are relevant for free zone companies. For the mainland, the participation exemption is the only carve-out.

May investment funds’ interests on their own be treated as shares or another equitable (ownership) interest?

3. According to Art. 2(1)(d) of the MoF’s Decision No. 265 of 27 October 2023, the holding of shares for investment purposes qualifies for the 0% Corporate Tax Rate. This includes:

- ‘shares of any class in the share capital of another juridical person or other types of equitable interests that entitle the holder to receive profits and liquidation proceeds, whether as a legal or beneficial owner… Shares and other securities are deemed to be held for investment purposes when held for an uninterrupted period of at least (12) … months’.

- Negotiable or non-negotiable financial instruments, including, derivative instruments, financial commodities, and other investment instruments that are or can be traded in a public or private market or that are convertible or exchangeable into a security or which confer a right to purchase a security, with the exception of the holding of financial or investment instruments that are issued pursuant to a securitization of receivables from a non-financial asset’.

Article 23(2) of the Corporate Tax Law reserves the Participation Exemption for a ‘Participating Interest’ which ‘means, a 5% … or greater ownership interest in the shares or capital of a juridical person’.

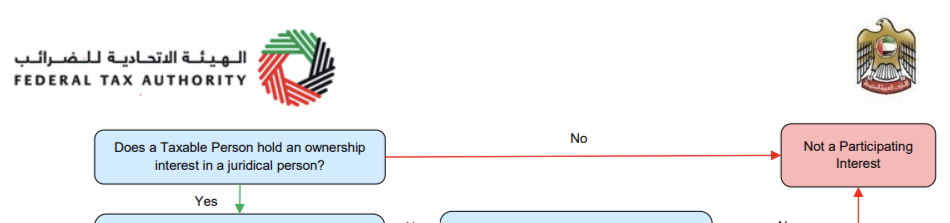

Below, is figure 2 from the FTA’s Corporate Tax Guide ‘Exempt Income: Dividends and Participation Exemption’ (October 2023) illustrating multiple tests which must subsequently be passed to claim the exemption.

The ownership interest is first and foremost. If this test is failed, the Exemption is not allowed. However, qualification for the 0% tax rate in a free zone may be still an option since other securities are allowed for such qualification.

4. The above norms admit shares for both the Participation Exemption and Qualifying Activity tests. Another ownership interest in capital may qualify for the Exemption if this interest may be defined as ‘other types of equitable interests’.

Article 2(2) of Ministerial Decision No. 116 of 10 May 2023 stipulates that ‘an ownership interest as referred to in Clause (1) of this Article, shall only be treated as such if it is classified as equity interest under the Accounting Standards as applied by the Taxable Person holding the ownership interest’.

This equates ‘other equitable interests’ mentioned in Decision No. 265 (the 0 rate qualification) with an ‘ownership interest’ in the Participation Exemption tests. The FTA recognizes this in Section 3.1.2.1 of the Exempt Income Guide: “for the application of the Participation Exemption, shares or similar interests equalizes terms ‘ownership interest’ and ‘equity instruments’…”.

Therefore, shares and an equity interest qualify for both tax benefits. Hence, clarification for one benefit may serve as clarification for both.

5. Section 3.1.2.1 of the FTA’s Corporate Tax Guide ‘Exempt Income: Dividends and Participation Exemption’ (October 2023) responds to the question ‘What is a share?’:

|

What is share? |

|

And further: ‘The instruments that are recognised as share capital and the rights attaching to shares are usually determined by the terms under which they are issued within the framework of the company law of the jurisdiction in which the company is incorporated’.

6. Section 5.1 of this Guide opposes shares to membership: ‘The first condition to qualify for the Participation Exemption is that a Taxable Person must hold an “ownership interest” in the shares or capital of a juridical person. The meaning of the term “share” is discussed in Section 3.1.2.1. Further, other methods of dividing capital that would constitute ownership interests include membership interests and other securities or rights that entitle the holder to profits and liquidation proceeds of the entity. Examples include interests in certain incorporated partnerships or units issued by an investment fund’.

Therefore, we may conclude at this stage that:

- units (membership) in an incorporated partnership shall be treated as “another method of holding capital” (other “ownership interests”) qualifying for the participation exemption with the same status as shares.

7. The next position mentioned in Art. 2(3)(d) of Decision No.265 is ‘other types of equitable interests that entitle the holder to receive profits and liquidation proceeds’.

|

Other equitable interests |

Definition sections of the General Corporate Tax Guide No. CTGGCT1 and Exempt Income Guide No. CTGEXI1 determines ‘Membership and Partner interests’ as ‘equity interests owned by a member or a partner in the juridical person, which entitles the member or the partner to a share of the profits, determined with reference to the member’s or the partner’s capital contribution, and which may be transferred to others’. |

Article 2(2) of Ministerial Decision No. 116/2023 and Sections 3.1.1.1 and 3.1.2.1 of the Exempt Income Guide direct one to Accounting Standards for the classification of an investment as an ‘equity interest’.

An ‘equity instrument’ is determined by IAS 32 “Financial Instruments: Presentation”. Term 4 of Para 11 of this Standard determines that ‘an Equity Instrument’ is ‘any contract that evidences a residual interest in the assets of an entity after deducting all of its liabilities’.

Example 1.

A UAE company invested in a US investment fund. The fund is registered in Delaware as Lim-ited Liability Company (LLC).

§ 18-101 of Delaware Limited Liability Company Act defines a “Limited liability company interest” as ‘a member’s share of the profits and losses of a limited liability company and a member’s right to receive distributions of the limited liabil-ity company’s assets’.

§§ 18-201(b) of this Act determines that ‘a lim-ited liability company formed under this chapter shall be a separate legal entity, the existence of which as a separate legal entity shall contin-ue until cancellation of the limited liability com-pany’s certificate of formation’.

The membership interest in this company is defi-nitely meets the definition of an equity interest cited above.

This allows us to consider the membership interest in a Delaware LLC as subject to the Participation Exemption and Qualifying Activity tests unless this company doesn’t fit the definition of a Foreign Unincorporated Partnership.

Unincorporated Partnership Test for a Foreign Invest Fund

8. Article 1 of the Corporate Tax Law determines a ‘Foreign Partnership’ as ‘a relationship established by contract between two Persons or more, such as a partnership or trust or any other similar association of Persons, in accordance with laws of a foreign jurisdiction’.

In the Example 1 with Delaware LLC, ‘a limited liability company agreement shall be entered into or otherwise existing either before, after or at the time of the filing of a certificate of formation…’. §§ 18-201(d) of the Delaware Limited Liability Company Act

In the Example 1 with Delaware LLC, ‘a limited liability company agreement shall be entered into or otherwise existing either before, after or at the time of the filing of a certificate of formation…’. §§ 18-201(d) of the Delaware Limited Liability Company Act

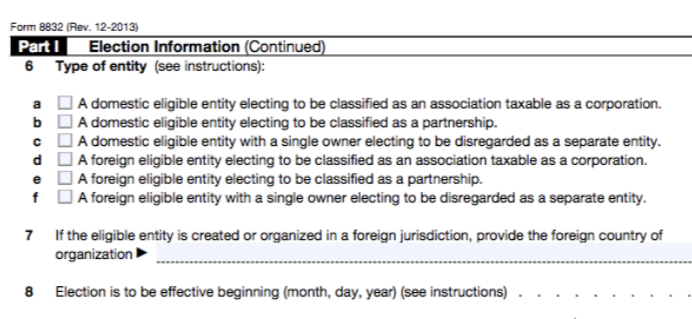

As per the US Internal Revenue Service clarification, ‘a Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner’s tax return (a disregarded entity).

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation.

For income tax purposes, an LLC with only one member is treated as an entity disregarded as separate from its owner, unless it files Form 8832 and elects to be treated as a corporation. However, for purposes of employment tax and certain excise taxes, an LLC with only one member is still considered a separate entity’.

Therefore, Delaware LLC shall be treated as Foreign Partnership unless it applied with IRS to be treated as a corporation.

9. Clause 7 of the Article 16 of the Corporate Tax Law sets out that ‘a Foreign Partnership shall be treated as an Unincorporated Partnership for the purposes of this Decree-Law where all of the following conditions are met:

- The Foreign Partnership is not subject to tax under the laws of the foreign jurisdiction.

- Each partner in the Foreign Partnership is individually subject to tax with regards to their distributive share of any Income of the Foreign Partnership as and when the income is received by or accrued to the Foreign Partnership.

- Any other conditions as may be prescribed by the Minister. The Minister prescribed these other conditions in Decision No. 127 of 24 May 2023. Clause 1 of Article 4 of this Decision stipulates that the following conditions shall be additionally met:

- The Foreign Partnership submits an annual declaration to the FTA to confirm meeting the conditions, specified in above paragraphs (a) and (b), in the form and manner and within the timeline prescribed by the FTA.

- Adequate arrangements exist for cooperation between the UAE and the jurisdiction under whose applicable laws the Foreign Partnership was established, for the purpose of sharing tax information of the partners in the Foreign Partnership.

Moreover, the Minister clarified in Clause 2 of this Article that ‘each partner in the Foreign Partnership shall be considered to be subject to tax if they would be subject to tax on their distributive share of any income in the Foreign Partnership in the jurisdiction in which the partner is a tax resident’. So, to pass condition (b) of the test on an Unincorporated Partnership, the taxation of each partner’s income shall be examined to establish whether it is subject to tax in each partner’s jurisdiction.

Example 2.

Continuing Example 1, Delaware investment fund in form of LLC meets the conditions (a) and (b) unless it hasn’t elected to be treated as corporation.

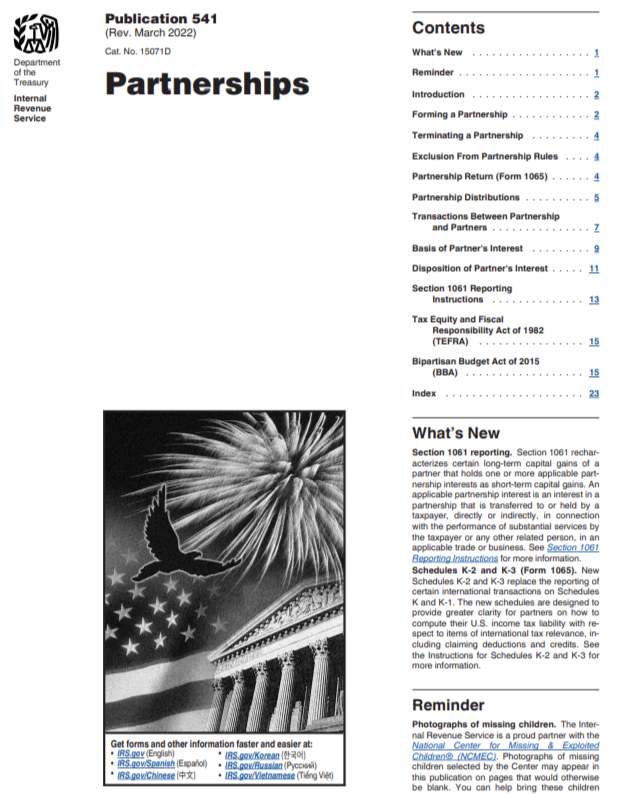

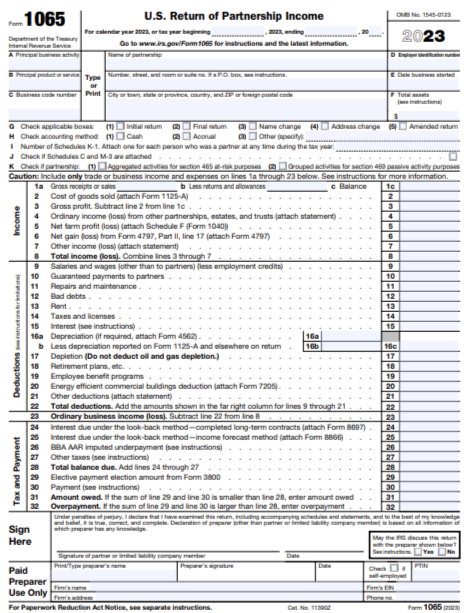

IRS Publication 541 (Rev. March 2022) Cat. No. 15071D provides clear guidance: ‘Generally, a partnership doesn't pay tax on its income but “passes through” any profits or losses to its partners. Partners must include partnership items on their tax returns’.

The IRS also clarifies that ‘A part-nership must file an annual in-formation return to report the in-come, deductions, gains, losses, etc., from its operations, but it does not pay income tax. In-stead, it "passes through" prof-its or losses to its partners. Each partner reports their share of the partnership's income or loss on their personal tax return’.

However, conditions (d) and (e) have to be additionally verified. If:

- the Fund submits an annual declaration to the FTA (d) and

- “adequate” cooperation to share information between the UAE and USA is arranged,

the fund is to be treated as an Un-incorporated Partnership.

It doesn’t seem feasible to establish facts, which allow a Foreign Partnership to passes the Unincorporated Partnership test. However, if the test is passed, Cl. 2 of Art. 16 of the Corporate Tax Law shall be applied. It sets out that ‘a Person who is a partner in an Unincorporated Partnership shall be treated as:

- Conducting the Business of the Unincorporated Partnership.

- Having a status, intention, and purpose of the Unincorporated Partnership.

- Holding assets that the Unincorporated Partnership holds.

- Being party to any arrangement to which the Unincorporated Partnership is a party’.

10. Clause 3 of this Article sets forth that ‘the assets, liabilities, income and expenditure of the Unincorporated Partnership shall be allocated to each partner in proportion to their distributive share in that Unincorporated Partnership, or in the manner prescribed by the Authority where the distributive share of a partner cannot be identified’. Pursuant to Cl. 4 of the same Article ‘the Taxable Income of a partner in an Unincorporated Partnership shall take into account the following:

- Expenditure incurred directly by the partner in conducting the Business of the Unincorporated Partnership.

- Interest expenditure incurred by the partner in relation to contributions made to the capital account of the Unincorporated Partnership’.

What if the Unincorporated Partnership Test is failed?

11. There is no clarity on the treatment in a more realistic scenario, i.e. where the Foreign Partnership has not passed the Unincorporated partnership test. We may assume 2 options are available:

- The 1st is to treat it as an incorporated partnership. It seems logical that if the conditions to be treated as an unincorporated partnership are not fulfilled, the partnership may not be treated as unincorporated and shall be treated as incorporated.

- The 2nd option is to treat it according to the partnership agreement. This option is illogical as it brings about the same treatment as is reserved for an unincorporated Partnership, i.e. it is allowed only for those Foreign Partnerships that have passed the test. It would be weird if a partnership which hadn’t passed the test were treated as if it had passed it.

You may see that 1st option has more rationale. However, Sec. 8.2.2 of the General Corporate Tax Guide No. CTGGCT1 clarifies: ‘Where a partnership is incorporated in the UAE and has a separate legal personality, as is the case for Limited Liability Partnerships and Limited Partnership Companies, they will be treated as a juridical person for Corporate Tax purposes. Their treatment will, therefore, be the same as other juridical persons such as Limited Liability Companies and Public Joint Stock Companies’. The foreign partnership is not incorporated in the UAE. This hinders this clarification from being applied to the situation at hand.

Nevertheless, in our opinion, this may not prevent the application of the 1st version. The 2nd version is only one alternative which I found and its rationale is much more vulnerable than in the 1st version. Besides, the 1st version stems from an obligation of a foreign partnership to prove its unincorporated status. In other words, it is a presumption of incorporated status with a legal personality. This presumption has to be either rebutted by passing the Unincorporated Partnership test, or the legal personality and incorporation status stay presumed.

12. Where the 1st option is applied, the partner may not credit tax which the partnership paid on its own. Only withholding tax may be credited.

Pursuant to Article 16(6) of the Corporate Tax Law ‘for the purposes of calculating and settling the Corporate Tax Payable of a partner in an Unincorporated Partnership under Chapter Thirteen of this Decree-Law, any foreign tax incurred by the Unincorporated Partnership shall be allocated as a Foreign Tax Credit to each partner in proportion to their distributive share in the Unincorporated Partnership’. Since the partnership is to be treated as Incorporated, in a same way as an LLC in the UAE, the status of the tax paid by the partnership is the same as tax paid by a foreign company with separate legal personality.

However, tax which a partnership directly withheld from the UAE partner may be credited according to the general rules specified in Art. 47 of the Corporate Tax Law. A Foreign Tax Credit may not exceed the amount of UAE Corporate Tax assessed on the same income. Therefore, it is not applicable where 0% Corporate tax is applicable or where income is exempted in the UAE.

13. Therefore, in our opinion until the Unincorporated Partnership test is passed, the foreign partnership shall be treated as incorporated. In this scenario ‘their treatment will, therefore, be the same as other juridical persons such as Limited Liability Companies and Public Joint Stock Companies’. Sec. 8.2.2 of the General Corporate Tax Guide No. CTGCT1.

In such scenario partnership or membership units are to be treated as ‘other types of equitable interests that entitle the holder to receive profits and liquidation proceeds’. If they have been held for a period of 12 months or longer, income generated by these units qualifies for the 0% Corporate Tax rate.

In a case where the Unincorporated Partnership test is not passed, the Participation Exemption tests shall be conducted with units issued by the Fund as ‘Membership and Partner Interests’ Sec. 8.2.2 of the General Corporate Tax Guide No. CTGCT1.

or ‘Other types of securities, capital contributions and rights that entitle the owner to receive profits and liquidation proceeds’. Ibid, Para (d)

What are the benefits from the Unincorporated Partnership Test being passed?

14. As per Art. 16(6) and Art. 47 of the Corporate Tax Law, for the purposes of calculating and settling the Corporate Tax Payable of a partner in an Unincorporated Partnership, any foreign tax incurred by the Unincorporated Partnership shall be allocated as a Foreign Tax Credit to each partner in proportion to their distributive share in the Unincorporated Partnership.

That is the benefit gained by the test being passed. In contrast to a corporation, tax paid on partnership income and withheld from the partner may not be credited in the UAE. Rather, it shall be treated as income tax paid by the corporation which is not allowed for a Foreign Tax Credit. Otherwise, I can’t make out what the benefit is from the Unincorporated Partnership test being passed.

1. Let’s elaborate on this using examples.

1. Let’s elaborate on this using examples.

Example 2.

A company incorporated in the UAE invested in an Irish investment fund which is registered in Ireland as an investment limited partnership. It is treated as a partnership in Ireland with no legal personality transparent for tax purposes.

This investment fund received a dividend from the company incorporated in Saudi Arabia. The latter with-held a 5% dividend.

This Saudi withholding (allotted to the specific partner) may be recognized for a Foreign Tax Credit in the UAE if the Irish Fund passes the Unincorporated Partnership Test in the UAE. If it doesn’t, then the Fund is seen as an entity separate from the partner. Hence, tax with-held from one person may not be credited from tax calculated by the Emirati partner.

If a foreign partnership is transparent, it pays no tax on its profits but income of the partnership may be subject to withholding tax. The source jurisdiction deems this income withheld from the UAE partner. However, the UAE, by default, disregards the pass-through approach and treats this income as income tax paid by the foreign corporation on its income. The result is that no tax is paid by the UAE partner in the source jurisdiction and no tax credit in the UAE is allowed.

15. The next 3 examples employ withholdings typical of US investment funds structured as transparent partnerships.

IRS Publication 541 (Rev. March 2022) Cat. No. 15071D elucidates that ‘a partnership that has foreign partners or engages in certain transactions with foreign persons may have one (or more) of the’ withholding obligations, such as:

- ‘Fixed or determinable annual or periodical (FDAP) income. A partnership may have to withhold tax on distributions to a foreign partner or a foreign partner’s distributive share when it earns income not effectively connected with a U.S. trade or business. A partnership may also have to withhold on payments to a foreign person of FDAP income not effectively connected with a U.S. trade or business’.

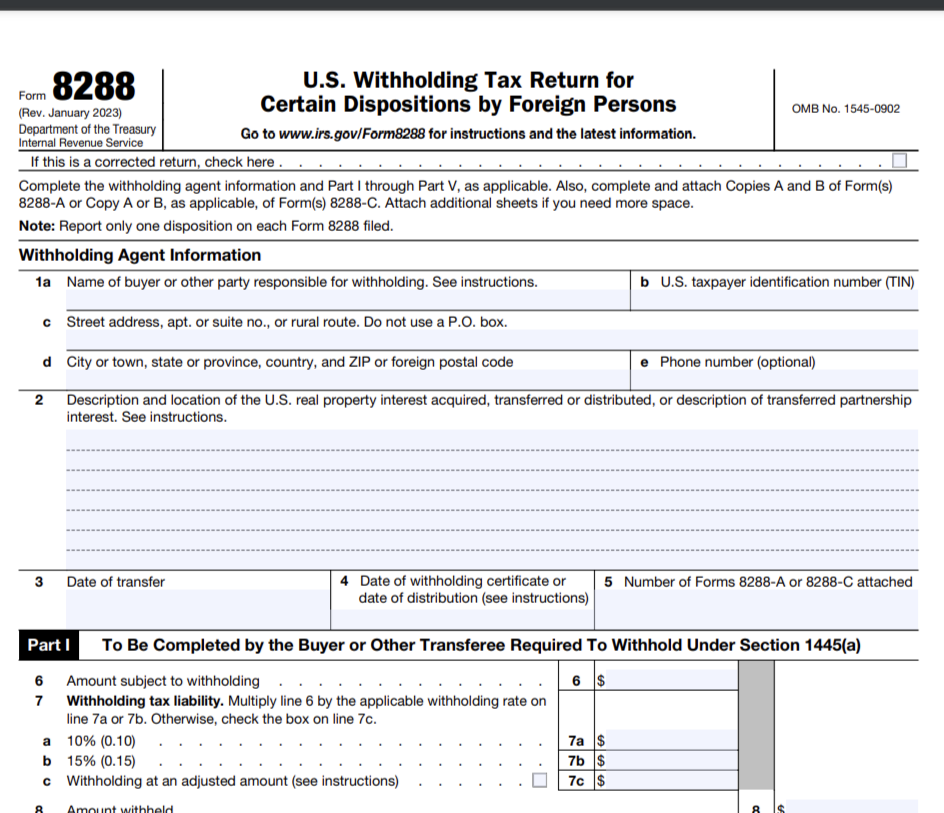

- ‘Withholding under the Foreign Investment in Real Property Tax Act (FIRPTA). If a partnership acquires a U.S. real property interest from a foreign person or firm, the partnership may have to withhold tax on the amount it pays for the property (including cash, the fair market value (FMV) of other property, and any assumed liability)’.

- ‘Withholding on foreign partner’s sale of a partnership interest. A purchaser of a partnership interest, which may include the partnership itself, may have to withhold tax on the amount realized by a foreign partner on the sale for that partnership interest if the partnership is engaged in a trade or business in the United States’.

- ‘Withholding under the Foreign Account Tax Compliance Act (FATCA). A partnership may have to withhold tax on distributions to a foreign partner of a foreign partner’s distributive share when it earns withholdable payments. A partnership may also have to withhold on withholdable payments that it makes to a foreign entity’.

- ‘Withholding on foreign partner’s effectively connected taxable income (ECTI). If a partnership has income effectively connected with a trade or business in the United States (including gain on the disposition of a U.S. real property interest), it must withhold on the ECTI allocable to its foreign partners’.

Example 3.

Example 3.

A Delaware LLC investment fund hasn’t applied to the IRS to be treat-ed as a corporation. The Partnership has invested in immovable assets in the US.

The Fund paid tax on effectively con-nected taxable income (ECTI), allo-cated it to the partners and withheld it

from income allocable to its foreign partners.

Unlike other withholding obligations applying when payments are made, the partnership is required to withhold ECTI tax whether or not the foreign partner’s share of income is actually distributed.

If the fund passes the Foreign Unincorporated Partnership Test in the UAE, this withholding is allowed for Foreign Tax Credit in the UAE.

If it doesn’t... The first idea that comes into mind is that then such tax credit is not allowed since the withholding shall be treated as tax being paid by the foreign incorporated partnership on its income. However, this doesn’t do it justice. Under Section 1146(d)(1) of the Internal Revenue Code (IRC), ‘each foreign partner of a partnership shall be allowed a credit under section 33 for such partner’s share of the withholding tax paid by the partnership under this section. Such credit shall be allowed for the partner’s taxable year in which (or with which) the partnership taxable year (for which such tax was paid) ends’.

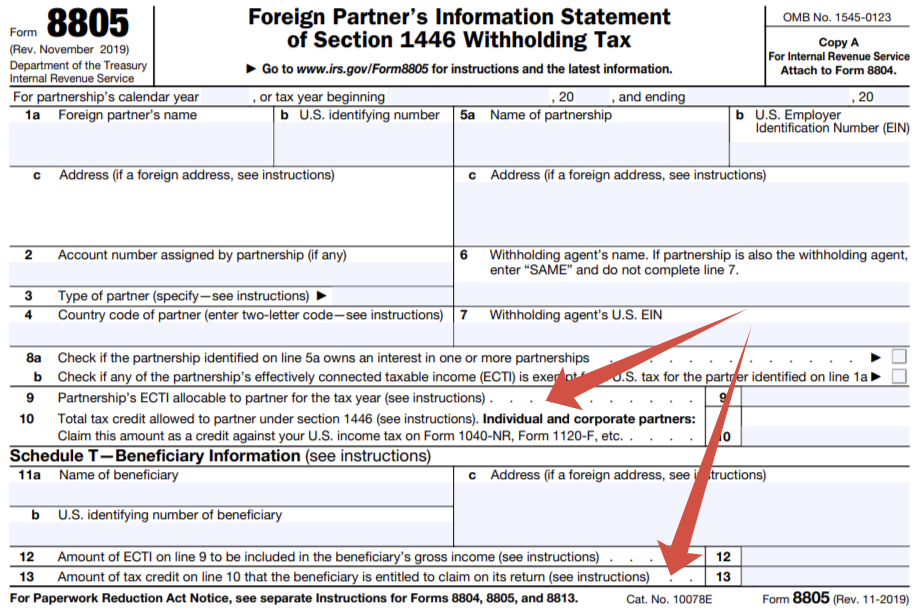

The partnership files a separate Form 8805 for each foreign partner ‘to show the amount of ECTI and the total tax credit allocable to the foreign partner for the partnership's tax year’. See IRS’ Instructions for Forms 8804, 8805, and 8813 (Rev. November 2022)

In my opinion, this gives enough rationale to claim that tax on ECTI withheld is paid by the partner through the partnership rather than by the partnership as a separate entity. I believe that such tax is allowed for a Foreign Tax Credit in the UAE regardless of which status the tax intermediary (the partnership) has: whether it is incorporated or not. Therefore, the test for a Foreign Incorporated Partnership is irrelevant for such case.

Example 4.

Example 4.

The same Delaware Fund made a withhold-ing “on foreign partner’s sale of a partner-ship interest… to the partnership…’.

The fund withheld this tax from distribu-tions to the UAE investor of the investor’s distributive share. It seems that this tax is allowed for a Foreign Tax Credit in the UAE regardless of whether the Foreign Unincor-porated Partnership Test is passed or not.

Placing the UAE rules in an international context

16. The UAE’s Foreign Incorporation Partnership Test stems from the OECD’s recommendations given in the BEPS Action 2 Final Report on Hybrid Mismatch Arrangements. A case where a ‘person … is treated as a separate entity by an investor and as transparent under the laws of the establishment jurisdiction’ is defined as a ‘reverse hybrid’. Recommendation 4.2. Another wording to describe reversal hybrid is ‘an entity that is only treated as transparent under the laws of the payer jurisdiction’ (para 136 of the Report).

The OECD’s Hybrids Report (2012) sets out “linking rules” to address hybrid mismatch arrangements, i.e. ‘rules which link the tax treatment of an entity, instrument or transfer to the tax treatment in another. The OECD recognises, though, that such rules ‘make the application of domestic law more complicated’. We may conclude that the UAE’s rules do exactly that.

Recommendation 2.2 of this Report is this: ‘In order to prevent duplication of tax credits under a hybrid transfer, any jurisdiction that grants relief for tax withheld at source on a payment made under a hybrid transfer should restrict the benefit of such relief in proportion to the net taxable income of the taxpayer under the arrangement’. In a case with reverse hybrids, this means that the jurisdiction where a transparent entity (partnership) operates should deal with the hybrid ramifications.

In the EU, the BEPS findings in the Action 2 report have been implemented in Council Directive (EU) 2017/952 of 29 May 2017 (ATAD2). This has amended the earlier issued Directive (EU) 2016/1164 to deal with hybrid mismatches with third countries. Clause 1 of Article 9a of the amended Directive ordains that: ‘Where one or more associated non-resident entities holding in aggregate a direct or indirect interest in 50 per cent or more of the voting rights, capital interests or rights to a share of profit in a hybrid entity that is incorporated or established in a Member State are located in a jurisdiction or jurisdictions that regard the hybrid entity as a taxable person, the hybrid entity shall be regarded as a resident of that Member State and taxed on its income to the extent that that income is not otherwise taxed under the laws of the Member State or any other jurisdiction’.

This ATAD2 rule is consistent with Recommendation 2.2 of the BEPS Action 2 Report as it charges a state where a hybrid entity is established with an obligation to deal with tax treatment mismatches by disregarding local transparent status.

Example 5.

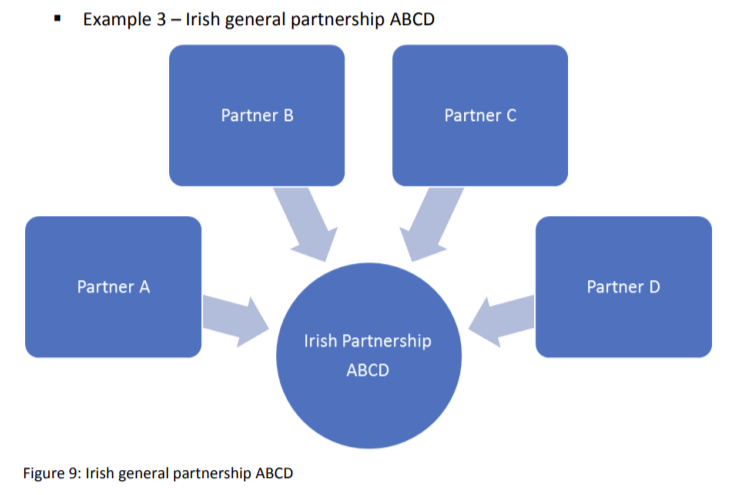

This example is taken from para 12.5.1 of the Irish Revenue’s Guidance on the anti-hybrid rules Part 35C-00-01. Last reviewed November 2023

In this figure, Irish partnership ABCD is treated as tax transparent in Ireland. The profits and gains of ABCD are treated as arising directly to the partners.

Partner A, B and C are located in territories that also regard ABCD as tax transparent. As such, Partner A, B and C are taxed on their share of ABCD’s profits and gains as they arise.

However, Partner D is located in a territory that regards Irish partnerships as separate taxable persons. As such, territory D treats the profits and gains as arising to ABCD on its own account such that Partner D is not taxed on his/her share.

In this example, Partner D holds a 51% share in ABCD. Partner D therefore holds a “relevant ownership interest” and is therefore a “relevant participator”. Accordingly, the share of the profits that are attributable to a relevant participator, Partner D, goes untaxed in both Ireland and territory D. In this regard, there is a reverse hybrid mismatch outcome.

How is a reverse hybrid mismatch outcome may be neutralised? The Revenue answers this in Para 12.5.3 of the Guidance: ‘Where a reverse hybrid mismatch outcome does arise the untaxed profits or gains that are attributable to the relevant participator are charged to Corporation Tax in Ireland as if the partnership or CCF was a company resident in the State for that tax period. Essentially, the partnership or CCF81 must register for, calculate and pay Corporation Tax in respect of the untaxed portion of profits and gains. In this context, the partnership … will file a Form CT1 for the relevant tax period and complete that form, in respect of the untaxed portion of profits/gains, as if it were a company resident in the State’.

17. The UAE approach seems inconsistent with the BEPS Action 2 and ATAD2 approach.

Under the UAE scheme a foreign partnership may not be treated as such unless the above test is passed. In my opinion, this rather creates the reverse hybrid mismatch in a case where it otherwise doesn’t appear.

Indeed, by default, a Foreign Partnership may not be treated as unincorporated. Even where there is no ambiguity in the transparent status of the partnership, the Minister proposes to the Foreign Partnership to submit an annual declaration to the FTA to confirm transparency. If the partnership doesn’t take advantage of this offer, it may not be treated as unincorporated, hence no transparency rules reserved for the unincorporated option are applicable in the UAE. The result of this is that a reverse hybrid mismatch manifests itself. It ensues from the rules designed to deal with the hybrid phenomenon which, in my opinion, makes no sense.

Example 6.

Let’s assume that in Example 5 above:

- Partner A is a company which is a Corporate Tax resident in the UAE, and

- no partner is ‘holding in aggregate a direct or indirect interest in 50 per cent or more of the voting rights’ in Partnership ABCD; and

- the partnership invests in real estate.

There are clear provisions in Irish law which treat Partnership ABCD as a tax transparent foreign partnership. In this scenario:

- ‘the Foreign Partnership is not subject to tax under the laws of the foreign jurisdiction’, hence condition (a) of Article 16(7) of the UAE Corporate Tax Law is met.

- ‘Each partner in the Foreign Partnership is individually subject to tax with regards to their distributive share of any income of the Foreign Partnership as and when the income is received by or accrued to the Foreign Partnership’. Thus, condition (b) of Article 16(7) of the UAE Corporate Tax Law is also met.

The UAE could choose to reckon with these facts and treat the partnership as unincorporated/transparent, as nothing in the UAE legislation hinders it from doing so. Instead, two additional conditions set, which the UAE partner could hardly control:

- Partnership ABCD shall submit an annual declaration to the FTA to confirm transparency for all partners, and

- adequate arrangements shall exist for cooperation between the UAE and Ireland for the purpose of sharing tax information of the partners in the Foreign Partnership.

In a case where these conditions are not met, the UAE treats the partnership as incorporated abroad and that is exactly the point from which the reverse hybrid mismatch arises.

So, if the UAE treats Partnership ABCD as incorporated, Partner B may consider the Participation Exemption and or the 0% Corporate Tax rate for the distributed profits. Even if no relief is applicable for distributed profit, operational profit allocated to partner D still remains untaxed.

If the UAE doesn’t deny the obvious transparency of the partnership, neither the participation exemption nor the 0% rate may be applied to the distributed income. The operation income doesn’t fall within the scope of qualifying activity as it ensues from an operation with immovable property.

That is where I puzzled with the rules included in Art 4(1) of Ministerial Decision No. 127 of 24 May 2023 since above consideration may lead to a conclusion that these rules defeat the implied purpose: instead of fighting the mismatch they create it.

Example 7.

Again, let’s take Example 5 with all corrections from example 6 except for one. Partner D (who is not a tax resident of the UAE) owns a share of more than 50% in partnership D.

In this scenario, Partner D is a “relevant participator”, hence untaxed profits or gains that are attributable to him are charged to Corporation Tax in Ireland as if the partnership is a company resident in Ireland.

This directly affects Partner A, who is not a “relevant participator” and operational profit and gains attributable to his share are still not subject to tax for Partnership ABCD in Ireland. However, Article 16(7)(b) the UAE Corporate Tax Law disregards the partnership’s transparency status. As per this Article, ‘each partner in the Foreign Partnership is individually subject to tax with regards to their distributive share…’.

Hence, in this case, a hybrid mismatch is imminent for Partner B by virtue of the anti-mismatch rule in Article 16(7)(b) of the UAE Corporate Tax Law.

Zero rate and participation exemption facets

18. The Unincorporated Partnership rules in Article 16 of the Corporate Tax Law are designed specifically to treat income of a foreign partnership; hence they take priority over other (general) rules. General rules allow for treatment as equity membership units in foreign unincorporated partnerships. However, specific rules shift the tax focus from the unincorporated partnership to the operation it conducts. This operation is to be treated as being conducted by a member himself. Therefore, the member shall:

- Delineate every particular investment of an investment fund (partnership) which gained income. This may be, for example, shares or another equity interest in a corporation, or it may be real estate purchased.

- Check if this particular investment qualifies for the 0% Corporate Tax rate. To continue the example above, shares may qualify if obtained for an interrupted period of 12 months, but investments in Real Estate do not qualify.

- Verify if this investment qualifies for the Participation Exemption. For example, a membership share may pass the 5% ownership test. However, the membership is not an appropriate subject for verification. Instead, the investment of the fund shall be examined. It is clear that an investment in Real Estate does not fit. However, shares in a corporation may do so. In the latter case the investment of the partnership (fund) in the shares shall be tested, and here again:

- If the partnership invested in testing shares below 5%, the ownership test is not passed by every partner.

- If the partnership invested in 5% of the company’s shares or more, part of this investment shall be allocated to the partner to be tested separately:

- If the allocated part of the investment is below 5%, the ownership test is not passed by the partner.

- If the amount spent on the allocated part of the shares is below AED 4,000,000, the minimum acquisition cost test (an alternative to the minimum ownership test) is also failed.

- Establish if any tax has been paid on the investment income in the foreign jurisdiction. If income does not qualify for the 0% rate and hasn’t passed the Participation Exemption test, the Company is to pay 9% Corporate Tax. This tax may be credited (reduced) by the amount paid in the US. If 9% or more has been paid, the Corporate Tax will be reduced to 0.

Case studies

19. Some illustrations for the above findings have been given earlier in this research. Additional illustrations follows below for investment funds established in the Cayman Irelands and the UK. US funds will be addressed once again but this time for limited partnership arrangements.

At the end, we elaborate on partnership arrangements that have no recognition in the form of any registration in a state.

Cayman Mutual and Private Funds

20. First and foremost, we should figure out if the fund is a partnership, i.e.:

- Is it based on ‘a relationship established by contract between two Persons or more’?

- Is it ‘a partnership or trust or any other similar association of Persons, in accordance with laws of a foreign jurisdiction’? Article 1 of the Corporate Tax Law

21. Section 2 of the Cayman Islands Mutual Funds Act (2021 Revision) defines “mutual fund” as ‘a company, unit trust or partnership that issues equity interests, the purpose or effect of which is the pooling of investor funds with the aim of spreading investment risks and enabling investors in the mutual fund to receive profits or gains from the acquisition, holding, management or disposal of investments …’.

An identical rule for Private Funds is included in Section 2 of the Cayman Islands Private Funds Act (2021 Revision).

Therefore, Private and Mutual Funds in the Cayman Islands can be a partnership, company or unit trusts.

22. Above Acts defines “Partnership” as:

- ‘a limited partnership registered under the Partnership Act (2013 Revision)’.

- ‘an exempted limited partnership’ (ELP) registered under section 9(1) of the Exempted Limited Partnership Act (2021 Revision);

- ‘a limited liability partnership’ (LLP) registered under the Limited Liability Partnership Act (2021 Revision); or

- ‘a partnership constituted under the laws of a jurisdiction other than the Islands’.

Pursuant to Cayman Ireland General Registry, ‘the Cayman Islands partnerships do not have separate legal personality. There are currently three types of partnerships that exist under the Cayman Islands Law namely Exempted Limited Partnerships, Foreign Partnerships and Limited Partnerships’. https://www.ciregistry.ky/partnerships-register/ However, Limited Liability Partnerships are an exception. As per Section 4(4) of the LLP Act (2021), LLP ‘is an entity with legal personality other than a body corporate which is separate and distinct from the partners of the LLP’.

The definition of a partnership, foreign partnership and unincorporated partnership don’t include a separate legal personality in the constituent features. Any relationship established by contract that is treated as a partnership in the laws of foreign jurisdictions falls under the definition of a foreign partnership given in Article 1 of the Corporate Tax Law.

Section 21(1) of the Partnership Act (2013) stipulates that ‘all property and rights and interests in property originally brought into the partnership stock or acquired, whether by purchase or otherwise, on account of the firm, or for the purposes and in the course of the partnership business, are called in this Law partnership property, and must be held and applied by the partners exclusively for the purposes of the partnership and in accordance with the partnership agreement’.

The same definition of a “partnership agreement” is given in Section 2 of the ELP Act (2021). Section 16(1) provides similar regulation for an ELP’s property: ‘Any rights or property of every description of the exempted limited partnership, including all choses in action and any right to make capital calls and receive the proceeds thereof that is conveyed to or vested in or held on behalf of any one or more of the general partners or which is conveyed into or vested in the name of the exempted limited partnership shall be held or deemed to be held by the general partner and if more than one then by the general partners jointly, upon trust as an asset of the exempted limited partnership in accordance with the terms of the partnership agreement’.

Section 13(1) of the LLP Act (2021) envisages that ‘rights and duties of the partners in a limited liability partnership shall, as between the partners, be determined by the partnership agreement’, which is ‘any agreement of the partners as to the affairs of a limited liability partnership and the rights and obligations of the partners among the partners’.

Therefore, all above forms of partnerships with or without a separate legal personality act on a partnership agreement constituting the partnership under Caymans’ laws.

23. However, there are no direct taxation laws in the Cayman Islands. In 2022, the Caymans reported that ‘it has no direct tax system and does not impose income, corporate, capital or other direct taxes’. OECD (2022), Making Dispute Resolution More Effective – MAP Peer Review Report, Cayman Islands (Stage 2): Inclusive Framework on BEPS: Action 14, OECD/G20 Base Erosion and Profit Shifting Project, OECD Publishing, Paris, https://doi.org/10.1787/6ef52ae4-en.

Hence, this exempted status doesn’t contribute anything to any income received by the partnership being not subject to corporate or similar tax in Caymans.

This raises the question of a whether a partnership in Caymans may meet substantive conditions of the Foreign Unincorporated Partnership test.

Any Cayman entity fits the condition from Clause (a) in Art. 16(1): ‘The Foreign Partnership is not subject to tax under the laws of the foreign jurisdiction’.

Caymans entities are exempted not by virtue of their ‘tax transparent’ status in respect of their partners, but by the absence of corporate income taxes in the Islands. This makes it tricky to prove compliance with Clause (b) of Article 16(7), which requires ‘each partner in the Foreign Partnership’ to be ‘individually subject to tax with regards to their distributive share of any income of the Foreign Partnership as and when the income is received by or accrued to the Foreign Partnership’.

A case with an LP and LLP fund may be resolved more easily than a case where a fund operates as an ELP. Indeed, an LP and LLP don’t have a personality separate from their partners. Therefore, their share in the partnership’s incomes naturally falls to the partners. A special provision for it to be taxed at the level of the partnership is required for it to be non-compliant with Article 16(7)(b) of the Corporate Tax Law. There is no such provision in the Caymans.

This approach is not applicable to a fund registered as an ELP due to it having a personality separate from its partners.

Section 38(1) of the Exempted Limited Partnership Act (2021 Revision) authorizes ‘the Financial Secretary…, on application by a general partner, give an undertaking in respect of any exempted limited partnership that a law which is hereafter enacted in the Islands imposing any tax to be levied on profits or income or gains or appreciations shall not apply to the exempted limited partnership or to any partner thereof in respect of the operations or assets of the exempted limited partnership or the partnership interest of a partner therein’. Section 38(3) determines that ‘any undertaking as aforesaid may be for a period not exceeding fifty years from the date of the approval of the application…’. This exemption doesn’t allow us to conclude that an ELP is exempted due to its pass-through status.

Being interpreted as the anti-hybrid rule, Art. 16(7)(b) of the Corporate Tax Law shouldn’t be applied in cases where tax is not payable due to the general features of the payer jurisdiction (i.e. where there is no mismatch in the treatment of the tax status of the payer). OECD BEPS Action 2 Report (2015), Example 1.6, 1.7, para 387, ATAD2, Recital 9.

Therefore, an exempted limited partnership’s potential to meet the condition under Art. 16(7)(b) of the Corporate Tax Law is disputable.

24. As earlier established, Cayman Mutual and Private funds may be operated in the form of a company.

Section 163 of the Companies Act (2021 Revision) determines that an exempted company is a ‘company …. the objects of which are to be carried out mainly outside the Islands or pursuant to a licence to carry on business in the Islands to which section 174 refers’. Section 166 sets out that ‘the shares of an exempted company shall be non-negotiable and shall be transferred only on the books of the company’.

According to Section 3 of the Partnership Law (2013 Revision) ‘the relation between members of any company or association which is

- registered as a company under the Companies Act (2021 Revision) or any other law for the time being in force and relating to the registration of companies; or

- formed or incorporated by or in pursuance of any other law, letter patent or Royal Charter,

is not a partnership within the meaning of this Law’.

Since Art. 1 of the Corporate Tax Law determines Foreign Partnership as ‘a relationship established by contract between two Persons or more, such as a partnership or trust or any other similar association of Persons, in accordance with laws of a foreign jurisdiction’, exempted company is not a partnership.

You have sound reason to ask why we concluded the opposite in case with LLC in the US. This was because, being the company in the US, LLC is deemed as partnership for the purpose of tax. It is not the case in Caymans where the legislator specifically ordained that a company may not be treated as a partnership.

So, in my view, in this scenario, the fund is not subject to the Foreign Unincorporated Partnership Test.

25. Where the Unincorporated Foreign Partnership test is failed (or irrelevant as in case where fund is not a partnership), the next step is to compare the features of the UAE partner’s interest (membership, unit, etc.) with the “ownership” or “equity” interest, i.e. to pass the ownership interest test for the Participation Exemption.

As per Section 2 of the Mutual Funds Act, an “equity interest” in mutual fund means ‘a share, trust unit, partnership interest or any other representation of an interest that —

- carries an entitlement to participate in the profits or gains of the company, unit trust or partnership; and

- is redeemable or repurchasable … before the commencement of winding-up or the dissolution of the company, unit trust or partnership…’.

Pursuant to Section 2 of the Private Funds Act, an “investment interest” means ‘a share, LLC interest, trust unit or partnership interest that — (a) carries an entitlement to participate in the profits or gains of the company, unit trust or partnership; and (b) is not redeemable or repurchasable at the option of the investor’.

Section 32(2) of the LLP Act sets out that ‘subject to the partnership agreement, any limited liability partnership property remaining after payment of the liabilities described in subsection (1) shall be distributed equally to the partners’.

Section 36(3) of the ELP Act prescribes that the provisions of the Companies Act (2021 Revision) and the Companies Winding Up Rules, 2018 are applied ‘to the winding up of an exempted limited partnership and for this purpose — (b) the limited partners shall be treated as if they were shareholders of a company…’.

For the LP, Section 44 of the Partnership Act provides that ‘in settling accounts between the partners after a dissolution of partnership… (iv) the ultimate residue (if any) shall be divided among the partners in the proportion in which profits are divisible’.

Therefore, in our opinion:

- shares of a Mutual or Private Fund registered as a company,

- another equity interest in a Mutual Fund or investment interest in a Private Fund registered in the form of an LLP, and

- those interests in an LP and ELP that failed the Unincorporated Foreign Partnership Test in the UAE,

may be treated as an equitable (ownership) interest for the purpose of the 0% Corporate Tax rate and Participation Exemption.

26. According to Art. 23(2)(b) of the Corporate Tax Law ‘a Participating Interest means, a 5% … or greater ownership interest in the shares or capital of a juridical person, … where all of the following conditions are met: b) The Participation is subject to Corporate Tax or any other tax imposed under the applicable legislation of the country or territory in which the juridical person is resident which is of a similar character to Corporate Tax at a rate not less than the rate specified in paragraph (b) of Clause 1 of Article 3 of this Decree-Law’.

As established above, there is no tax of similar nature in Cayman Islands. Therefore, condition stipulated in Art. 23(2)(b) is not met.

However, Art. 23(3)(a) of the Corporate Tax Law sets forth that a Participation shall be treated as having met this condition ‘where all of the following conditions are met:

- The principal objective and activity of the Participation is the acquisition and holding of shares or equitable interests that meet the conditions of Clause 2 of this Article.

- The income of the Participation derived during the relevant Tax Period or Tax Periods substantially consists of income from Participating Interests’.

Thus, the Fund from the Cayman Islands with no direct taxation may theoretically pass subject to 9% tax but only if its principal objective is holding equity interests in companies located in countries having corporate tax of 9% or higher.

Furthermore, the Cayman Fund may also pass subject to tax test where it is treated as taxpayer for the corporate or similar tax in other country.

27. The subject to tax test is not applicable for the 0% Corporate Tax rate. Therefore, a company registered in a UAE free zone may still be in position to apply the 0% rate subject to other conditions being met.

28. As found above, funds operating in the forms of an ELP and LP are likely to pass the substantive conditions of the Foreign Unincorporated Partnership Test. If in addition to this:

- the fund submits an annual declaration to the FTA and

- “adequate” cooperation to share information between the UAE and Cayman Islands is arranged,

- each partner’s income is subject to tax in the jurisdiction which the partner is from.

the fund in Cayman Islands is to be treated as an Unincorporated Partnership.

In this case, the conclusions made above should be applied. The partner shall:

- delineate every particular investment of the Fund, which gained income;

- check if this particular investment qualifies for the 0% Corporate Tax rate;

- verify if this investment qualifies for the Participation Exemption;

- if the UAE investor is not entitled to the above reliefs, Foreign Tax Credit should be considered. This is applicable where tax has been withheld from a payment received by the fund (partnership).

Investment in Private Funds in the UK

29. Section 3 of the UK Limited Partnership Act 1907 defines “private fund limited partnership” as ‘a limited partnership that is designated under section 8(2) as a private fund limited partnership’. In contrast to LLP Section 1(2) of the UK Limited Liability Partnerships Act 2000, the Limited Partnership Act does not consider LP to be an entity with legal personality which is separate and distinct from the partners of the limited partnership. There is a difference between limited partnerships registered in England and Wales, Northern Ireland, and those registered in Scotland. Only those limited partnerships registered in Scotland have separate legal personality from the partners themselves, with the ability to own property or enter into contracts. Those registered in England and Wales, and Northern Ireland have no separate legal personality and have no such ability. See Department for Business, Energy and Industrial Strategy Consultation Paper “Limited Partnerships: Reform Of Limited Partnership Law”.

Therefore, the UAE partner shall proceed with Unincorporated Partnership Test described above.

30. Partnerships, including LPs, are transparent for tax purposes. This means that the partnership itself is not subject to tax: any profits are instead taxable on the partners. Each partner is individually responsible for paying tax due on their share of the partnership profits. See HMRC Partnership Tax Return Guide notes (2022) Updated 6 April 2023.

Thus, condition (a) of the Unincorporated Partnership Test is met. However, the rest has to be additionally verified. If:

- the Fund submits annual declaration to the FTA and

- “adequate” cooperation to share information between the UAE and United Kingdom is arranged,

- each partners income is subject to tax in the jurisdiction which the partner is from,

the Private Fund in the UK is to be treated as Unincorporated Partnership in the UAE.

In this case, the partner shall:

- Delineate every particular investment of the Private Fund in UK, which gained income;

- Check if this particular investment qualifies for 0% Corporate Tax rate;

- Verify if this investment qualifies for the Participation Exemption;

- Establish if any tax has been paid on the investment income in the UK. If income does not qualify for the 0% rate and hasn’t passed Participation Exemption test, the Company is to pay 9% Corporate Tax. As established earlier, this tax may be credited (reduced) by the amount paid in the UK. If 9% or more has been paid, the Corporate Tax will be reduced to 0.

31. As shown above, unless the test is passed, the foreign partnership shall be treated as incorporated. In this scenario ‘their treatment will, therefore, be the same as other juridical persons such as Limited Liability Companies and Public Joint Stock Companies’. In such scenario, contributions from the partner are to be treated as ‘other types of equitable interests that entitle the holder to receive profits and liquidation proceeds’. If their holding period is 12 months or longer, income generated by these units qualifies for the 0% Corporate tax rate.

32. According to Art. 23(2)(b) of the Corporate Tax Law ‘a Participating Interest means a 5% … or greater ownership interest in the shares or capital of a juridical person, … where all of the following conditions are met: … b) The Participation is subject to Corporate Tax or any other tax imposed under the applicable legislation of the country or territory in which the juridical person is resident which is of a similar character to Corporate Tax at a rate not less than the rate specified in paragraph (b) of Clause 1 of Article 3 of this Decree-Law’.

Since the partnership itself is not subject to tax, the condition stipulated in Art. 23(2)(b) is not met unless the fund qualifies for exception reserved for holding companies, i.e.: Article 23(3) of the Corporate Tax Law

- The principal objective and activity of the holding company is the acquisition and holding of investments that also meet the conditions of Participating Interest.

- The income of the holding company substantially consists of income from the Participating Interests.

Besides, the UK Fund may also pass subject to tax test where it is treated as taxpayer for the corporate or similar tax in other country.

33. Where investments in fund (which failed unincorporated test) doesn’t pass any of the Participation Exemption tests, the investor from a UAE free zone may still be in position to apply 0% Corporate Tax. The 12 months period of holding shall be verified in this case in row with other conditions set for zero-rating.

34. Finally, where income from the fund is subject to 9% UAE Corporate Tax, the Foreign Tax Credit shall be addressed for the tax withheld from the partner’s income.

Where Foreign Unincorporated Partnership test is passed, tax withheld from an income received by the partnership is also creditable.

Investment in US limited partnerships

We considered above investment in a US investment fund registered in Delaware as Limited Liability Company (LLC).

In this section, we address the funds which set up in compliance with the US Uniform Limited Partnership Act 2001 last amended in 2013.

According to Section 110 of this Act, ‘a limited partnership is an entity distinct from its partners. A limited partnership is the same entity regardless of whether its certificate states that the limited partnership is a limited liability limited partnership’.

However, in the USA, partnerships, including limited partnerships (LPs), are transparent for tax purposes. This means that the partnership itself is not subject to tax: any profits are instead taxable on the partners. According to 26 U.S. Code § 701 “A partnership as such shall not be subject to the income tax imposed by this chapter. Persons carrying on business as partners shall be liable for income tax only in their separate or individual capacities”. See also IRS clarification and publication above.

Therefore, a UAE partner shall proceed with the Unincorporated Partnership Test described above.

If test is passed, the US LP fund is to be treated as Unincorporated Partnership and therefore every particular income gained by the partnership shall be tested for the Participation Exemption and 0% corporate Tax Rate. The algorithm is pretty much the same as earlier elaborated for the UK LP fund.

Profit sharing agreements

35. In contrast of earlier considered arrangements, the partnership may operate under the contract between the partners which is not required to be registered in any state authority.

Consider this as an example. The Company A plans to invest in a certain project. If the Company B is also interested in the project, then it gives funds to the Company A under the profit sharing agreement, and the company A buys in its name a consolidated position in the project (for example, company shares, participation interests, or a limited partnership interest) both for itself and for Company A.

The profit sharing agreement can also be used for existing investments of third parties, for example, the Company A already has an investment in a start-up and is ready to give the Company B exposure on the investment in return for paying the cost of the investment, without directly selling this investment in favour of the Company B.

In any of the cases, the Company B does not have a direct participation in the project, but indirectly (through a profit-sharing contract with an investor company) bears all the risks of the investment in proportion to its share and also receives a return on that investment in proportion its share.

36. A Foreign Partnership is defined as ‘a relationship established by contract between two Persons or more, such as a partnership or trust or any other similar association of Persons, in accordance with the laws of a foreign jurisdiction’. Article 1 of the Corporate Tax Law.

The profit sharing agreement may serve as such contract.

These types of arrangement differ from the forms of partnerships already considered above by the lack of any registration or other state recognition of the partnerships. However, the definition of a Foreign Partnership doesn’t include registration in the body of the relevant features. Article 16 on the treatment of Foreign Partnerships and Unincorporated Partnerships doesn’t factor foreign registration in. Therefore, there are no grounds for different treatment of such partnerships.

37. ATAD2 doesn’t restrict its rules to “entities” but extends its regulation over “arrangements”. Article 2(9)(i) of the Directive says that a ‘hybrid entity’ means ‘any entity or arrangement that is regarded as a taxable entity under the laws of one jurisdiction and whose income or expenditure is treated as income or expenditure of one or more other persons under the laws of another jurisdiction’.

The Revenue in Ireland includes in an ‘entity’ for the purpose of hybrid mismatch regulations not only

- a person, undertaking, an agreement, trust or other arrangement that has legal personality

- ‘an association of persons recognised under the laws of the territory in which it is established as having the capacity to perform legal acts’,

but also in addition to them ‘(e) any other legal arrangement, of whatever nature or form, that is within the charge to any of the taxes covered by this Part’. Notes for Guidance – Taxes Consolidation Act 1997 – Finance Act 2023 Edition - Part 35C, 835Z.

As the Revenue has explained, ‘the purpose of paragraph (e) is to capture any other business form, that is not covered by paragraphs (a) to (d) but should be included within the scope of the antihybrid rules’.

38. This allows us to surmise that the algorithm previously specified for foreign partnerships is applicable to the profit sharing agreements at hand, i.e.:

- The test for Foreign Unincorporated Partnership is to be passed first with the most likely scenario being a failure to pass this test.

- If the test is passed, joint investment shall be checked for qualification. For example, where shares or other securities are purchased by another partner for profit sharing, these shares (other securities) shall pass the 12 month holding duration test;

- If the test is not passed, the arrangement shall be treated as a Foreign Incorporated Partnership where the UAE partner’s contribution shall be deemed as an equitable interest. This interest shall be tested for the duration of holding.

- This equity interest may be also within the scope of the Participation Exemption if relevant tests are passed.

39. However, a partner’s position is uncertain for such profit-sharing arrangements. The lack of the registration of a partnership exposes this case to the risk of an equity interest being challenged.

This risk is aggravated by Section 5.1.1 of the Corporate Tax Guide ‘Exempt Income: Dividends and Participation Exemption’ No. CTGEXI1. The FTA specifies that ‘a holding can qualify as an ownership interest for the purposes of [Participation Exemption] only if it is treated as an equity interest under the Accounting Standards applied by the Taxable Person holding the ownership interest… This would distinguish between an ownership interest and other rights to the profits and liquidation proceeds of an entity, such as profit-sharing agreements with employees that do not carry any equity rights to the entity or creditors’ rights to compel the sale of certain assets to satisfy an obligation of an entity that is in default’.

This position may be proved irrelevant where attributes of equity are proved, i.e. where the agreement entitles partners to a ‘residual interest in the assets of an entity after deducting all of its liabilities’. However, this will not be easy to do as there is no ‘entity’ set up by the parties.

Therefore, the safest position for such cases is to treat income as unqualified for the 0% Corporate Tax rate and for the Participation Exemption, or request a private clarification from the FTA and act accordingly.

Disclaimer

Pursuant to the MoF’s press-release issued on 19 May 2023 “a number of posts circulating on social media and other platforms that are issued by private parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law.

See the full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have status of the author’s opinion only. Like any human job, it may contain inaccuracy and mistakes that I have tried my best to avoid. If you find any inaccuracies or errors, please let me know so that I can make corrections.