The UAE Tax Case Study. Potential to have a first Corporate Tax Period beginning in November 2024

The facts

A Company has been set up in May 2023. It determined its first financial year as ending in 18 months, which falls on 31 October 2024. Subsequent financial years are determined as 12 months, i.e. from November 2024 to October 2025, and so on, going forward.

The question

What should the first Tax Period be for this Company? May it last 18 months as determined in its Memorandum of Association?

The summary

After considering the facts and the analysis below, we opine as follows:

- There is no specific rule answering this question in the UAE’s Corporate Tax legislation and Guidance;

- There are arguments to substantiate an answer of “Yes” and arguments in favour of the opposite answer.

- Saudi Arabia, Oman and Qatar have such special rules. The answer would, broadly, be “Yes” in these jurisdictions with substantial specific features in the KSA. These rules are not able to fill the gap in the UAE without similar changes being introduced in Emirati legislation or at least in the Guidance.

- In practice, the Company may not register itself for Corporate Tax with its first Tax Period beginning later than in May 2024.

- The first Corporate Tax Period for the Company at hand is the calendar year 2024, but the financial statements are to be prepared for the long fiscal year starting in May 2023 and ending in November 2024. Thus, the Company has to prepare two sets of accounts based on different periods.

- To avoid this, the Company may apply to the FTA to change:

- the start date of the first Tax Period from January 2024 to November 2024, and

- the end date from December 2024 to November 2025.

- The approval is not to be granted automatically. The Company must include a ‘valid commercial, economic, or legal reason’ in its application. It may use arguments from the Analysis to provide reasoning in the application.

- And, by the way:

Even companies that were established in February and May of 2023 and that determined their first Tax Period as 12 months from the month of their registration (February, March, April or May of 2024) may face issues.

The analysis

1. Article 57 of the Corporate Tax Law sets forth that:

- ‘A Taxable Person’s Tax Period is the Financial Year or part thereof for which a Tax Return is required to be filed.

- For the purposes of this Decree-Law, the Financial Year of a Taxable Person shall be the Gregorian calendar year, or the (12) twelve-month period for which the Taxable Person prepares financial statements’.

A literal interpretation of Clause 2 of this Article allows one to conclude that the Financial Year may not exceed 12 months. If the financial year of a company exceeds 12 months, then such period ‘for which the Taxable Person prepares financial statement’ does not fit; hence, the calendar year is the only option left. In such a case:

- the first financial year is 2023 as a whole,

- the first tax period is “a part thereof”, i.e. it starts at the moment when the company is set up and ends at the end of 2023.

This is for a company that was established in June 2023 or later, i.e. after the Corporate Tax Law came into effect.

2. Now it is the right time to address the transition period, i.e. a case where a Company had been set up before June 2023. Article 69 of the Corporate Tax Law sets out that ‘this Decree-Law shall apply to Tax Periods commencing on or after 1 June 2023’.

Article 61(1) of the Corporate Tax Law envisages that ‘a Taxable Person’s opening balance sheet for Corporate Tax purposes shall be the closing balance sheet prepared for financial reporting purposes under accounting standards applied in the State on the last day of the Financial Year that ends immediately before their first Tax Period commences, subject to any conditions or adjustments that may be prescribed by the Minister’.

Replacing “Financial Year” with its definition in Art. 57(2) leads us to the following: ‘a Taxable Person’s opening balance sheet for Corporate Tax purposes shall be the closing balance sheet prepared for financial reporting purposes under accounting standards applied in the State on the last day of the Financial Year Gregorian calendar year, or the (12) twelve-month period for which the Taxable Person prepares financial statements that ends immediately before their first Tax Period commences, subject to any conditions or adjustments that may be prescribed by the Minister’.

This doesn’t contribute much in terms of justifying the application of the “long” financial year. Again, “the (12) twelve-month period for which the Taxable Person prepares financial statements’ is not applicable for the long (exceeding 12 months) financial year. This also leaves the taxpayer with only one option. Let’s look at this option with the irrelevant opportunity additionally crossed off: ‘a Taxable Person’s opening balance sheet for Corporate Tax purposes shall be the closing balance sheet prepared for financial reporting purposes under accounting standards … on the last day of the Financial Year Gregorian calendar year, or the (12) twelve-month period for which the Taxable Person prepares financial statements that ends immediately before their first Tax Period commences, subject to any conditions or adjustments that may be prescribed by the Minister’.

Therefore, the tax person has only one option – the end of the current calendar year (2023) from which the first Tax Period starts, regardless of when the Company’s first long financial year ends.

3. The Minister of Finance (MoF) elucidates in its Explanatory Guide that:

- ‘this means that Persons who are within the scope of the Corporate Tax regime will become subject to Corporate Tax on a “rolling” basis, and the time of their entry into the Corporate Tax regime will depend on their Financial Year (i.e. the period for which the Person prepares their financial statements - see Article 57)’.

- ‘Persons that prepare their financial statements based on a calendar Financial Year (1 January - 31 December) will become subject to Corporate Tax from 1 January 2024, being the commencement date of their first Tax Period after 1 June 2023’.

- ‘Persons whose Financial Year does not align with the calendar year will become subject to Corporate Tax from the commencement date of their first Financial Year starting on or after 1 June 2023. For example, Taxable Persons with a Financial Year ending 31 March will become subject to Corporate Tax from 1 April 2024, and Taxable Persons with a Financial Year ending 30 September will become subject to Corporate Tax from 1 October 2023’.

- ‘The purpose of a staggered entry into the Corporate Tax regime is to minimise the compliance burden by avoiding the need for Taxable Persons to apportion income earned and expenditure incurred during an accounting period to periods where Corporate Tax is not applicable and where such income and expenditure become subject to Corporate Tax’.

All these insights don’t help those taxpayers whose financial year ends after 1 June 2023, which is not 12 months as in the examples given by the MoF.

4. In Section 6.2.1 of the General Corporate Tax Guide, the FTA clarifies that ‘a Taxable Person’s … Tax Period is their Financial Year, or part thereof, for which a Tax Return is required to be filed. This is usually the 12-month period for which they prepare their Financial Statements’.

The reference to “usual” raises hopes, but it could be interpreted as meaning that the purpose was to provide relief from the burden only to those whose case is usual. The FTA doesn’t say that, in an unusual case, the longer financial year shall be treated as the “Financial Year” and “Tax period” for Corporate Tax purposes.

5. In the Explanatory Guidance, the Ministry of Finance (MoF) comments on Article 57 of the Corporate Tax Law in this way: ’Allowing a Taxable Person to align their Tax Period to the period for which they prepare financial accounts avoids the compliance cost that would otherwise be incurred if the Taxable Person has to prepare two sets of accounts based on different periods…’. This comment points towards the possibility of using the same financial year in the accounting and for tax purposes even if this financial year exceeds 12 months.

Having said that, the MoF proceeds: ‘Clause 2 provides that Law …, the Financial Year of a Taxable Person is the Gregorian calendar year, or the 12-month period for which the Taxable Person prepares financial statements. On this basis, if a Taxable Person does not already prepare financial statements, they will by default have a January to December Tax Period’. This has the potential to be interpreted in two opposite ways:

- as obliging a newly established company, which has not yet prepared any financial statements, to determine its first Financial Year as ending on 31 December 2023, or

- the ‘January to December’ by-default option shall work only if the company does not opt for another period.

6. Article 28 of the Federal Commercial Company Law determines that ‘every Company shall have a fiscal year as determined in its Statute, provided that the first fiscal year of the Company does not exceed (18) eighteen months and is not less than (6) six months, commencing as of the date of the Company’s entry in the Commercial Register at the Competent Authority’.

Article 61 of this Law ordains that the following be determined: ‘the profits and losses and the share of each partner in the Company … at the end of the Company's fiscal year in accordance with the balance sheet and the profit and loss account’.

This Article determines the “fiscal” year rather than the financial one. “Fiscal” is used as a synonym of “tax” in Articles 27(2)(g) and 50(1)(a) of the Corporate Tax Law. Therefore, companies in the mainland and in the free zones, which don’t disallow federal corporate legislation See details here. may refer to the fact that 18 months is allowed for fiscal purposes. Corporate taxation is a composite of the fiscal regulations. Therefore, the cited provisions of the Commercial Company Law may be applied to fill the gap in clarity.

However, neither is this argument decisive. The FTA may object, citing Article 68 of the Corporate Tax Law. It abrogates ‘any text or provisions contrary to or inconsistent with the provisions of this Decree-Law’. Article 28 of the Federal Commercial Company Law with its provision concerning an 18-month first Fiscal Year may be deemed inconsistent with the 12-month Financial Year rule.

Furthermore, this argument may be dismissed in those free zones whose regulation prevents the application of the Commercial Company Law for a company registered within the free zones in question. For example, Regulation 184.9 of the DMCCA Commercial Company Regulations stipulates that ‘for the avoidance of doubt, the provisions of Federal Law No. 2 of 2015 Concerning Commercial Companies do not apply to any DMCC Entity’. Regulation 73.1 envisages a provision akin to Art. 28 of the Federal Commercial Company Law but replacing ‘fiscal’ with ‘’financial’: ‘… the first financial year of a Company starts on the day on which it is registered and lasts for a period determined by the Directors, which period must be at least six months and not longer than eighteen months’. Thus, DMCC companies may not avail themselves of the above argument with “Fiscal Year”.

On balance, the regulation and clarification for the case at hand is less then clear in the Emirates. Therefore, we examined other GCC members to have some guidance on what the FTA could use as a sort of best practice in the region.

|

Article 1 of Oman’s Income Tax Law, provides that ‘the first accounting period … may be less than twelve months or exceed such a period to a maximum of eighteen months’. |

|

The Qatar Financial Centre Guide to QFC Tax Return Completion says that ‘the first Accounting Period of a QFC Entity under the QFC Tax Regulations’ will have a ‘Start Date [which is] the date the QFC Company commenced activities under their QFC licence. The end date will match the chosen end date for the Accounting Period, but cannot be more than 18 months after the Start Date’. Similar rules are provided by Article 5 of Qatar’s Income Tax Executive Regulations: ‘Where a taxpayer commences activity thereof after the beginning of the taxation year, the first accounting period shall be computed from the beginning of such activity, or from the following year, provided that the accounting period shall not be less than six (6) months or more than eighteen (18) months’. |

Saudi Arabia is different. Article 22(c) of the Saudi Income Tax Law envisages that ‘the first year of a new taxpayer or the last year of a taxpayer in case of discontinuation or liquidation may be a short independent fiscal year, unless it is stipulated to be a long fiscal year in accordance with Companies Law’.

Having said that, Article 18(2) of ZATCA’s Income Tax Implementing Regulation stipulates that:

- ‘the taxpayer whose first fiscal year is a long year according to the memorandum of association of the company must submit a tax declaration for the period of 12 months from the beginning of his fiscal year within 120 days of its end.

- After the end of the long fiscal year, one declaration shall be submitted to the department and the tax that is due by virtue of it after deducting what was already paid for the first period.’

Therefore, if a Company is set up the KSA in May 2023 with the first fiscal year ending in 18 months (November 2024), it files two tax returns for this long year:

- an intermediate tax return after 12 months has expired from it being set up,

- an ultimate return for 18 months absorbing data from the intermediate return and deducting tax paid under the intermediate return.

This short survey demonstrates that:

- other GCC members recognize the relevance of the long first fiscal year provided for in companies’ by-laws, but

- they do so not by default (not like obvious or natural) but establishing this by a special rule, and

- these rules differ between member States.

The UAE’s regulation does not provide for such specific rules, which puts taxpayers in an uncertain position.

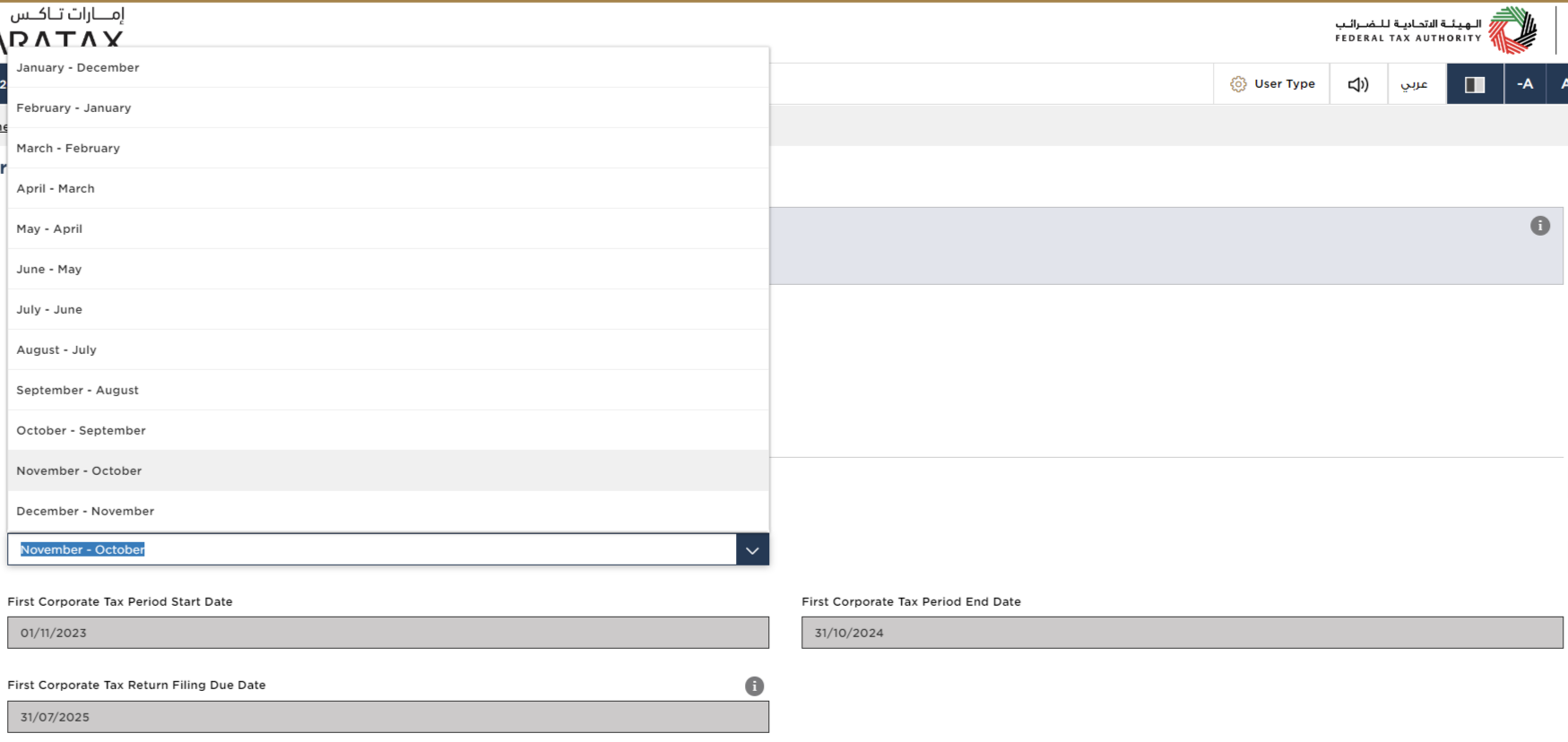

8. However, the software solution that the FTA used to have a Tax Person registered doesn’t provide an opportunity to factor in a long first fiscal year.

A tax person is required to choose the Corporate Tax Period as a 12-month interval. In the case at hand, the Company was incorporated in May 2023 and has its first financial year ending in October 2024, and a subsequent 12-month financial year commencing in November 2024. Thus, the Company is in a position to choose November-October. In doing so, the Company will have the fields for its First Corporate Tax Period start date auto populated as 01/11/2023. The potential to have first Corporate Tax Period start date later than May 1, 2024 is out of reach.

9. To obtain certainty and to have its first Tax period reconciled with the first long financial year, the Company may request the FTA to change the ending date of the first tax period (to use the first financial (fiscal) year selected in the Memorandum (Articles) of Association or in another form established by corporate legislation).

In Art. 2 of its Decision No. 5 of 7 April 2023, the FTA ruled that ‘the Taxable Person can make an application to the Authority to change the start and end date of the Tax Period, or use a different Tax Period, where the following conditions are met: …

- Aligning the Resident Taxable Person’s Financial Year with the Financial Year of another Resident Person for the purpose of forming a Tax Group or joining an existing Tax Group, or aligning the Taxable Person’s Financial Year with the Financial Year of its domestic or foreign head office, subsidiary, parent, or ultimate parent company, for the purpose of financial reporting...; or

- There is valid commercial, economic, or legal reason to change the Tax Period’.

As per Clause 4 ‘the application shall be made before the lapse of 6 months from the end of the original Tax Period’. In the case at hand, the original Tax Period is the “by default” option, i.e. the calendar year 2024. Thus, the Company shall apply for a change of this period by 1 July 2024.

10. To substantiate this application with a ‘legal reason’, a company may deploy the above argumentation adjusted to the specific situation.

The disclaimer

Pursuant to the MoF’s press-release issued on 19 May 2023 “a number of posts circulating on social media and other platforms that are issued by private parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law. See the full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have the status of the author’s opinion only. Like any human job, it may contain inaccuracies and mistakes that I have tried my best to avoid. If you find any inaccuracies or errors, please let me know so that I can make corrections.

The Acknowledgment

This Case study has benefited from the contributions of the following people:

Peter Brophy, Legal Editor and solicitor advising on English law, for his remarkable editing job, Nisham Contractor, Senior Manager at CNK Tax Consultants LLC, who provided useful discussion on theoretical frameworks.