The UAE Tax Case Study: Procurement from any Free Zone vs Distribution from a designated zone

The facts

A company is registered in a UAE free zone, not a designated one. This company is a part of a group of companies (the Group). Its function within the Group is to have other Group companies supplied with everything that they need for their business.

The Company has two options to implement it:

- 1st is a buy-sell option, i.e. to purchase from a third party supplier and resell to the intragroup customer. The profit here is generated by a mark-up on the resale price.

- 2nd is a commission (agency) model, i.e. to conclude a contract with a third party in its own name or in the name of intragroup client but on behalf of such client and at the client’s expense. In this model, profit is to be earned as commission (agency) fees.

The question

Does income earned in the 2nd model from a regular (non-designated) zone qualifies for the 0% Corporate Tax rate in the UAE?

General Considerations

2(1)(i) of Ministerial Decision No. 265 of 27 October 2023 qualifies for the 0% Corporate Tax rate ‘headquarter services to Related Parties’.

Article 2(3)(i) of this Decision sets forth that ‘headquarter services to Related Parties includes the administering, overseeing and managing of Business Activities of Related Parties, including the provision of senior and general management, captive insurance services, administrative services, procurement services, business planning and development, risk management, coordination of group activities, and in general incurring expenditures on behalf of Related Parties and providing other support services to Related Parties’.

The FTA’s insights on procurement

There is no definition of procurement services in the Corporate Tax law.

However, the FTA addresses procurement in its Transfer Pricing Corporate Tax Guide No. CTGTP1 (October 2023) Version of Nov 06, 2023.

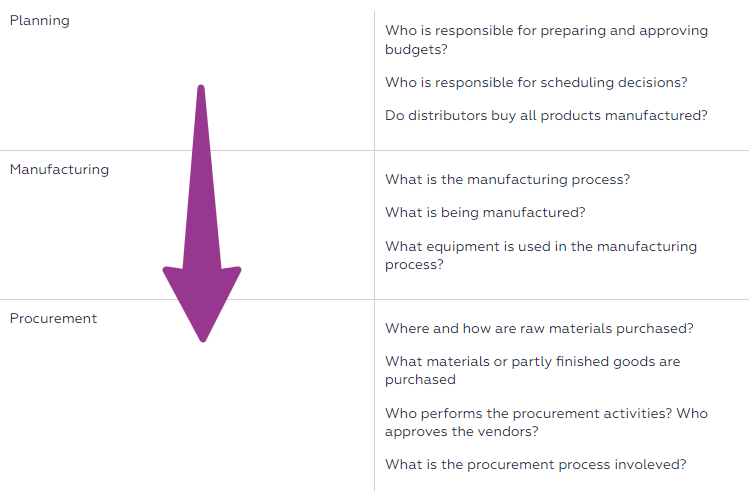

- Example 6 in Para 5.1.1.4 of this Table from the Guide shows ‘a sample list of questions that may be considered relevant for performing a Functional Analysis for a manufacturing entity’.

This list shows that procurement services may include assistance in purchasing ‘raw materials’ and ‘partly finished goods’. Art. 2(3)(a) of Ministerial Decision No. 265 (2023) defines ‘manufacturing’ as ‘the production, improvement or assembly of products and materials from raw materials or components’. Linking the Guide’s questionnaire with this Ministerial definition, leads to the conclusion that procurement may refer to the purchasing of raw materials and components (partly finished goods), i.e. materials required for the core function of manufacturing.

The FTA accompanies the list with a remark that ‘this list is not intended to be exhaustive and should be amended to cover the relevant aspects of the specific industry, characteristics of the Business of the Person’. Therefore, the answers to these questions may describe procurement activity, and:

- if they are relevant to a company’s business, this may definitely be used to evidence the procurement nature of the services,

- if they are not, the company may still present the features to be defined as procurement. This story should be in concert with specifics of the industry that the company belongs to, its business, etc.

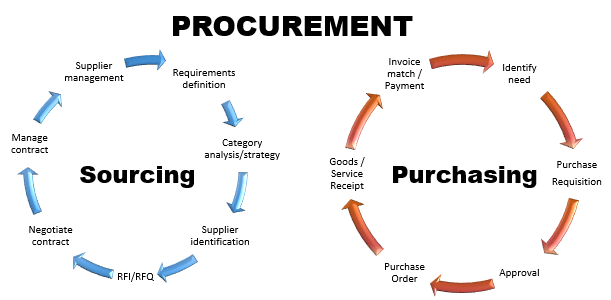

- Let’s check out how the FTA illustrates an investigation of the procurement function in the next example of the same Guide:

‘Company A has a procurement department staffed with 50 full time employees who have extensive experience in sourcing raw materials in the technology development industry. Working closely with the finance and legal department at Company A, this team undertakes end-to-end vendor due diligence and onboarding, including functions related to

- vendor identification,

- reviews,

- negotiations,

- selection and

- relationship management.

In addition, the department manages purchase planning and scheduling,

- inbound logistics and

- preliminary quality and

- specification control in relation to the sourced raw materials’.

These references to an ‘end-to-end’ solution and to the ‘procurement department … working closely with the finance and legal department’ in the same company gives rise to the issue of ancillary functions in procurement. If non-procuring functions are utilized in the procuring process, there is no need to divide the profit into a zero-rating procurement function and a general-rating legal function. The MoF:

- qualified in Art. 2(1)(n) of Decision No. 265 ‘any activities that are ancillary to the Qualifying Activities specified in paragraphs (a) to (m) of this Clause’, and

- in Art. 2(4) defined ‘ancillary’ as ‘activity … necessary for the performance of the main activity or where it makes a minor contribution to it and is so closely related to the main activity that it should not be regarded as a separate activity’.

The OECD’s guidance on procurement

The OECD Transfer Pricing Guidelines 2022 give some examples helping to understand the meaning of the group in multinational corporations.

- Para 1.84 of the Guidelines gives an example where ‘Company B manufactures products for Company A… Company B built and equipped its plant to Company A’s specifications, that products are manufactured to technical requirements and designs provided by Company A, that volume levels are determined by Company A, and that Company A runs the supply chain, including the procurement of components and raw materials…’.

This confirms the above conclusion that procurement comprises the purchase of key components and raw materials, not only purchases of minor importance (purchases for administrative, ancillary functions).

- Para 7.15 of the Guidelines elucidates the ‘form of the remuneration’ for procurement services: ‘… in some buying or procurement services a commission element may be incorporated in the price of the product or services procured, and a separate service fee may not be appropriate’.

This allows us to infer that a regular agency, commission or similar way of remuneration is a regular form of procurement contract. However, a resale agreement may also include remuneration for procurement services as well. This is a point for separate consideration, though.

- ‘The concentration of functions in a regional or central entity, with a corresponding reduction in scope or scale of functions carried out locally; examples may include procurement, sales support, supply chain logistics’.

A takeaway from this is that procurement is not the same as ‘supply chain logistic’.

- Para 9.25 gives an example where a business restructuring involves ‘the setting up by an MNE group of a central procurement operation that replaces the procurement activities of several associated enterprises’. The OECD comments as follows:

- … the MNE group has taken affirmative steps to centralise purchasing in a single group company to take advantage of volume discounts and potential savings in administrative costs. In accordance with the guidance in Chapter I, the benefits due to deliberate concerted group action should be allocated to the associated enterprises whose contributions create the synergies. However, in a business restructuring, the central procurement company may also contractually assume risk associated with buying, holding, and on-selling goods.

- … an analysis of risk … will determine the economic significance of the risk and which party or parties assume that risk. Although the central procurement operation is entitled to profit potential arising from its assumption of the risk associated with buying, holding, and on-selling goods, it is not entitled to retain profits arising from the group purchasing power because it does not contribute to the creation of synergies…’.

This also gives a ground to consider whether procurement may qualify for the 0% Corporate Tax rate if it is routed through ‘buying, holding, and on-selling goods’. Again, this issue is not addressed in this research and may be the subject of further separate consideration.

- Annex 2 to Chapter V of the Guidelines instructs the inclusion in the Local file of the TP documentation of ‘a description of the material controlled transactions (e.g. procurement of manufacturing services, purchase of goods, …)’. The FTA included the same direction in para 6.6.2.1 of the TP Guide.

Therefore, a local file may serve as evidence to position activity of the company as central procurement in the group. Or, the FTA may use it to prove the opposite where local file is inconsistent with such an intragroup position.

On balance, if a company is designated in a Group of Related Parties to conduct central procurement for the whole group or for 2 or more group members, this company may be defined as conducting procurement services.

How to distinguish Headquarter Procurement Services from Non-Headquarter Services?

However, on 10 August 2020, the Cabinet set new Economic Substance Regulation in Resolution No. 57. This distinguishes Service Center Business from Headquarter Business.

Both activities include the provision of services to Related Parties. However, headquarter services and not the service center qualify for the 0% tax rate. Therefore, it makes sense to figure out how qualifying headquarters services differ from non-qualifying services to other members of the Group.

Section 2.5 of the Relevant Activity Guidance Annexed to Decision No. 100 of the Minister of Finance of 19 August 2020 determines that ‘a Licensee is regarded as carrying on a Headquarters Business if the Licensee provides services to foreign group companies, and through the provision of such services:

- The Licensee takes on the responsibility for the overall success of the group; or

- The Licensee is responsible for an important aspect of the overall group’s performance’.

The latter may be the case as central procurement brings an ‘advantage of volume discounts and potential savings in administrative costs’. Para 9.25 of the OECD TP Guidelines.

Para 1.180 of the OECD TP Guidelines recognizes that:

- ‘If a group takes affirmative steps to centralise purchasing in a single group company to take advantage of volume discounts, and that group company resells the items it purchases to other group members, a deliberate concerted group action occurs to take advantage of group purchasing power.

- Similarly, if a central purchasing manager at the parent company or regional management centre performs a service by negotiating a group wide discount with a supplier on the condition of achieving minimum group wide purchasing levels, and group members then purchase from that supplier and obtain the discount, deliberate concerted group action has occurred notwithstanding the absence of specific purchase and sale transactions among group members’.

Therefore, central procurement takes responsibility for overall group performance in an aspects of:

- ‘purchasing power’ and

- ‘savings in administrative costs’ (since certain purchase functions in several members of the group are replaced by one centralized function and performance of this function simultaneously benefits the corresponding demands of several members).

This may be a reason to treat such central procurement services as Headquarter Business rather than as a Service Centre.

Section 2.5 of the Relevant Activity Guidance provides for certain criteria, which may be, at the first glance, used to beat the above conclusion. It sets out that in order for a UAE business ‘to be seen as having “taken on the responsibility for the overall or an important aspect of the overall group’s success or performance”, ‘the services provided by the entity must involve:

|

Headquarter Attribute |

Comment |

|

‘the provision of senior management’ |

Not the case where goods or services have been procured. |

|

substantive advice in relation to the assumption or control of material risk for activities carried out by foreign group companies. |

This also doesn’t fit. |

|

the assumption or control of material risk for activities carried out by foreign group companies |

This may work to back up the headquarter attribute in procurement service. |

True, where a central procurement service company is not included in the chain of supplies it usually doesn’t assume the risks inherent to purchase transactions. However, control of this risk may be a natural function of the procurement service. This company may:

- take the risk of choosing the best supply option from the market,

- assess the corresponding risk of dealing with this supplier,

- negotiating contractual terms related to risks and price corresponding to an agreed allocation of risks, etc.

Role of a procurement company’s position in the group

Section 2.5 of the Relevant Activity Guidance specifies that ‘a Licensee’s position in a group’s corporate structure is not relevant for determining whether it is engaged in a Headquarters Business’:

- ‘The Licensee does not need to be the direct or ultimate parent of a group company for it to be considered a Headquarters Business’.

- ‘Whether an entity carries on a Headquarters Business is entirely dependent on the nature of the services it provides to foreign group companies’.

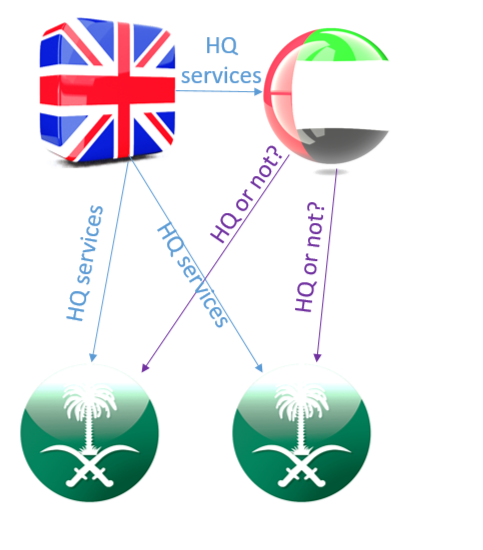

However, the example included in this section demonstrates that this guidance may be compromised. It illustrates a situation where the services rendered to other group companies shall not be deemed headquarter business:

However, the example included in this section demonstrates that this guidance may be compromised. It illustrates a situation where the services rendered to other group companies shall not be deemed headquarter business:

‘FGH LLC (UAE) is part of a UK headquartered group and has subsidiaries in the Kingdom of Saudi Arabia (“KSA”).

The senior management of FGH LLC have regular contact with the management of the KSA subsidiaries on the performance of their business and to share insights from the group.

FGH LLC (in its capacity as shareholder) has certain rights and influence in respect of the management and operations of the KSA subsidiaries’.

‘Nevertheless, the KSA subsidiaries follow the strategic direction and manage risks in line with the corporate policy set by the headquarters based in the UK’.

The Minister ruled that the UAE’s ‘FGH LLC is not considered to be providing ‘headquarters services’ because the strategic direction for the group is set by the headquarters in the UK and not by FGH LLC, and FGH LLC is not responsible for the performance of the subsidiaries in KSA’.

As we may see from this example:

- the services to the group company rendered by one entity may be deprived of the headquarter nature where another entity in the group provides these services;

- in such a case, the choice is to be made in favor of an entity whose services:

- must be performed by subordinate companies of the group This is relevant where services comprise directives from one entity and consultancy work from another entity, as in the example with KSA subsidiaries. It is not relevant for procurement services unless the procurement function includes directions to the subsidiaries on how to deal with procurement on their side. , or

- are accompanied with responsibility for the performance of the covered group entities.

- the service provider may be a sole shareholder of the service’s recipient. This puts the provider in a legal position to:

- give directions that are to be performed,

- enjoy the results of the performance of the subsidiaries (recipients of the services) or suffer from them.

However, the potential for giving a direction is irrelevant if the actual allocation of headquarter functions in the group is inconsistent with its legal (formal) allocation. In such case, actual responsibilities should be identified.

Conclusion 2(b) is relevant for procurement services. If the company in the UAE free zone merely follows the directions of the intragroup recipients, such procurement is not headquarter services. Likewise, if the company follows directions from another company of the group (not the recipient of whatever is procured), then the headquarter part of the procurement function is rather performed by this other company. Therefore, in both scenarios considered in this paragraph income earned by a free zone company in a free zone fits the definition of procurement services but doesn’t fit the definition of headquarter services. This hinders such income from qualifying for the 0% Corporate Tax rate.

Procurement and substance

Pursuant to Art. 8(1) of Cabinet Decision 100 of 25 October 2023: ‘A Qualifying Free Zone Person shall undertake its core income-generating activities in a Free Zone or a Designated Zone, depending on where such activities are required to be conducted…’.

Core Income Generating Activity (CIGA) is defined in Section 2.5 of the Relevant Activity Guidance as:

|

‘Taking relevant management decisions’ |

‘This CIGA refers to making decisions on the substantive functions and significant risks for group companies, such as decisions on material acquisitions and purchases, the group companies’ sales and marketing strategy, product development, business process standardization, etc.’ |

|

‘Incurring operating expenditures on behalf of group entities’ |

‘This CIGA could include engaging specialist advice or procuring technology on behalf of the group as a whole, or purchasing significant assets or specific services for or on behalf of group companies. |

|

‘Coordinating group activities’ |

This CIGA refers to ensuring that activities such as marketing, HR, IT, finance, tax etc. are coordinated and organised in a way that produces the best outcome for the group as a whole as opposed to individual group companies’. |

Localizing Procurement Decision-Making in a Free Zone

‘Making decisions on the substantive functions and significant risks for group companies’ in procurement includes in particular decisions on:

- how to deal with quality-related risks in procurement,

- how to exercise the group purchasing power in the best way possible (secure the best price with maximum guarantees and minimum risks, etc.)

- the development and implementation of the supplier risk management policy;

- decisions on vendor onboarding and replacement, etc.

Decision-making is a substantial distinguishing feature of headquarter procurement. The latter is qualifying activity. In contrast, procurement services by a Free Zone Person where the decision-making as to procurement is localized in other group entities (outside of a free zone) do not qualify.

There are some specific aspects in the localization of the decision-making function.

Section 2 of the Relevant Activity Guidance sets out the general rule for scenarios “where the CIGA involves making relevant decisions”. In such cases, “the majority of the persons making the decisions must be present in the UAE when the decision is made, in order for a decision to be considered as being made in the UAE”.

Since no other instruction is provided by Corporate Tax legislation and bylaws, this rule should work for tax as well. To distinguish ‘a decision to be considered as being made in’ a free zone from one being made outside of it, a taxpayer and the authorities should be governed by majority rule. At least, we see no argument to ignore this rule.

“Best outcome for the group as a whole”

‘Coordinating group activities’ implies a model where the procuring company aims for ‘the best outcome for the group as a whole as opposed to individual group companies’. See above.

This is where the taxpayers need to fine-tune things. On the one hand, the headquarter model implies that the interests of the group as a whole are pre-eminent. On the other hand, such model features shareholder’s activity. The latter is non-deductible for the recipient member of the group.

Indeed, both the OECD’s TP Guidance and the FTA’s TP Guide address shareholder activity as operations corresponding to no consideration if measured at Arm’s length. Para 7.9 of the OECD’s Guidance requires ‘a more complex analysis … where an associated enterprise undertakes activities that relate to more than one member of the group or to the group as a whole’.

‘An intra-group activity may be performed relating to group members even though those group members do not need the activity (and would not be willing to pay for it were they independent enterprises)’. This happens as per the OECD ‘in a narrow range of such cases’, and pursuant to the FTA Section 7.2.2.3 of the FTA’s TP Guide. ‘sometimes’. This remark gives hope that a regular procurement case would not fall within ‘a narrow range of such cases’.

Such optimism is justified by:

- A comparison of the OECD Guidance with the FTA’s Guide. The OECD includes in the description of shareholding activity its relation ‘to more than one member of the group or to the group as a whole’. However, the FTA doesn’t:

|

The OECD |

The FTA |

|

‘A more complex analysis is necessary where an associated enterprise undertakes activities that relate to more than one member of the group or to the group as a whole. In a narrow range of such cases, an intra-group activity may be performed relating to group members even though those group members do not need the activity (and would not be willing to pay for it were they independent enterprises)’ |

‘Sometimes in an MNE Group, an intra-group activity is performed relating to Group members even though those Group members do not need the activity (and would not be willing to pay for it were they independent of the Group)’. |

- Section 7.2.2.3 of the FTA’s TP Guide considers cases directly related to procurement: ‘Treatment of pass-through cost / reimbursement of expenses’. It states:

- ‘Sometimes, a Group company may arrange and pay for, on behalf of its Related Parties or Connected Persons, goods or services acquired from various vendors. These are generally called pass-through costs and are subject to reimbursement.

- ‘A question may arise as to whether the Group company arranging and paying for such goods or services should add a profit element to the amount paid to the vendors when recharging such costs to Related Parties or Connected Persons’.

The FTA replies to this question in this way:

- ‘The Group service provider may pass on the costs from the vendors without a profit element or mark-up provided that’ in particular ‘the Group service provider is merely the paying agent and does not enhance the value of the acquired goods or services in the process whatsoever’. This is not the case where procurement function goes beyond paying agent status and features headquarter activity.

- On the contrary, ‘the Group service provider should nonetheless consider charging an appropriate arm’s length standard margin for its function in arranging and paying for the acquired goods or services on behalf of its Related Parties or Connected Persons. This should be based on (but not limited to) the aggregate costs of performing the function, and reflect the nature of its own services and extent of value-add generated for the Related Parties or Connected Persons’.

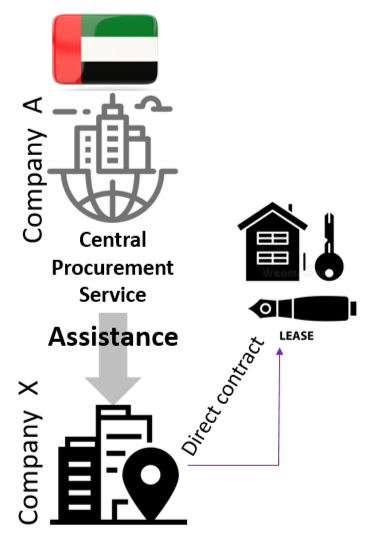

The FTA provides the Example below to illustrate this:

‘Example 18: Treatment of pass-through cost as well as service cost

‘Example 18: Treatment of pass-through cost as well as service cost

Company A is the parent company of an MNE Group headquartered in the UAE. It has wholly owned subsidiaries in countries X and Y. Company A has a centralised procurement team responsible for all procurement related activities for the Group.

The subsidiary in country X seeks support from the procurement team to arrange additional office premises. Based on the request, the procurement team invites bids and assists in the entire life cycle of leasing the office premises.

The FTA resolves this example in this way: ‘In determining the arm’s length charge, Company A should apply an arm’s length mark-up to the costs incurred in providing procurement support during the arrangement of the lease. Company A is also expected to recover the lease rental cost from its subsidiary without a mark-up’...’

The FTA resolves this example in this way: ‘In determining the arm’s length charge, Company A should apply an arm’s length mark-up to the costs incurred in providing procurement support during the arrangement of the lease. Company A is also expected to recover the lease rental cost from its subsidiary without a mark-up’...’

0% for the resale of services, leases… anything but goods.

In the FTA’s example above, the procurement of a lease is illustrated. This may be illustrated by purchases of any services, IP products, etc.

In contrast, qualifying distribution covers only ‘goods, materials, component parts or any other items that are tangible or movable’. Art. 2(3)(l) of Ministerial Decision No. 265.

Thus, the zero-rating from procurement is distinguished from zero-rating for distribution.

So it's not enough that a designated zone is not required to qualify for the 0% Corporate Tax rate, but the scope of purchases being resold to a group company via the procurement model is wider.

Procurement vs Distribution: purpose of a purchase

There is no such or similar condition for procurement services. The scope of qualifying customers is limited to Related Parties only.

License issues

It always makes sense to make sure that a taxpayer’s free zone allows it to obtain Or extend the existing license. a license for “procurement services”, “headquarters services” or another license suitable to cover centralized supply relationships under an agency agreement.

It also makes sense to contact the administration of the free zone or the clients’ support service of the zone in order to make sure that the existing or chosen license allows the company to carry out this activity, and the description of the activity will not hinder procurement from qualifying as headquarters services.

For example, in DMCC, we have found no special licenses for the activities of providing headquarters services or centralized supply services. If you use this zone, then, in our opinion, the Company can obtain a license under the code 5110-03 “Commercial Brokers”, covering ‘firms engaged in bringing sellers and buyers involved in wholesale and retail trade together in return of a commission or remuneration, these firms are neither allowed to trade on [their] own account nor practice brokerage in real estate, services, shares and bonds and finance’.

However, this description does not allow this activity to be linked to headquarters services in any way. Therefore, in a request addressed to the administration of the zone, it makes sense to ask:

- for a clarification as to whether it covers “centralized intra-group procurement services for the related parties acting as disclosed or undisclosed agent purchasing the goods from the third parties on behalf and at the expanse of the intragroup beneficial recipient”.

- for advice on which license, if not this one, better fits this activity.

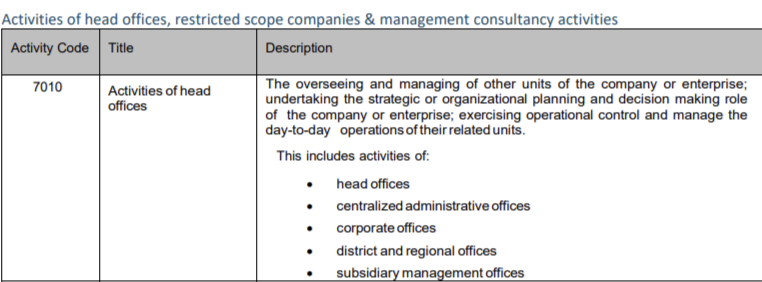

ADGM has special code for licensing head office activities:

However, procurement services are not specified in it. Therefore, the same clarification may be requested from ADGM authority’s support team.

However, procurement services are not specified in it. Therefore, the same clarification may be requested from ADGM authority’s support team.

The request should be drafted so that it can be used as proof of intent to cover transactions related to qualifying activities. Therefore, the wording matters. It makes sense to keep the correspondence. It may serve as evidence in potential tax and/or regulatory disputes.

Conclusions

The analysis performed above allows us to conclude as follows:

- If the Company applies a procurement model, it may enjoy the 0% Corporate Tax rate even if it is not registered in a UAE designated free zone Provided that all other conditions are met.

- The downside of the procurement model is that it doesn’t cover sales to out-of-group members. Distribution from a designated zone fits better for such sales.

- The principal upsides of the procurement option are:

- There is no need to set up in (or move to) a designated free zone. A regular free zone suffices to qualify for the 0% Corporate Tax rate.

- Procurement covers leases, services, intangibles, etc., i.e. not only goods and materials.

- The procurement mark-up is to be zero-rated even where resale wasn’t a customer’s purpose of purchase.

- The risks of a tax dispute exist. The level of such risks depends on the nature of intragroup arrangements and functions allocated to the procurement company.

- License issues should be additionally addressed as it may happen that a regular trade license doesn’t cover the commission (agency) model.

Mitigating Risks

To mitigate risks of a dispute with the FTA, companies opting for the 0% tax rate in procurement services may:

- use in contracts with intragroup recipients wording similar to that used in sub-paragraphs (i) and (m) of paragraph 3 of Article 2 of Decision No. 265 and in Section 2.5 of the Relevant Activity Guidance, e.g. “acting on behalf of the whole Group and on behalf of the Client as a member of the Group”, “procuring”;

- have intra-group policies and other documents authorizing the free zone procurement provider to carry out central procurement functions including decision-making and other risk management;

- have intragroup contracts consistent with these policies and arrangements;

- have the free zone procurement provider represented in TP documentation as responsible for central procurement;

- have role profiles, jobs descriptions, and employment contracts consistent with the headquarter status of the company, i.e. this evidence shall demonstrate the employees responsible for CIGAs inherent for the headquarter activity;

- have KPI for the employees of the free zone procurement team linked with performance of the whole group (or the relevant part thereof).

The disclaimer

Pursuant to the MoF’s press-release issued on 19 May 2023 “a number of posts circulating on social media and other platforms that are issued by private parties, contain inaccurate and unreliable interpretations and analyses of Corporate Tax”.

The Ministry issued a reminder that official sources of information on Federal Taxes in the UAE are the MoF and FTA only. Therefore, analyses that are not based on official publications by the MoF and FTA, or have not been commissioned by them, are unreliable and may contain misleading interpretations of the law. See the full press release here.

You should factor this in when dealing with this article as well. It is not commissioned by the MoF or FTA. The interpretation, conclusions, proposals, surmises, guesswork, etc., it comprises have the status of the author’s opinion only. Like any human job, it may contain inaccuracies and mistakes that I have tried my best to avoid. If you find any inaccuracies or errors, please let me know so that I can make corrections.