The UAE Tax Case Study. Definition of a Designated Zone for Corporate Tax purposes

This slide from the recent webinar addresses definition of a Designated Zone (DZ) for the UAE Corporate Tax (CT) purposes.

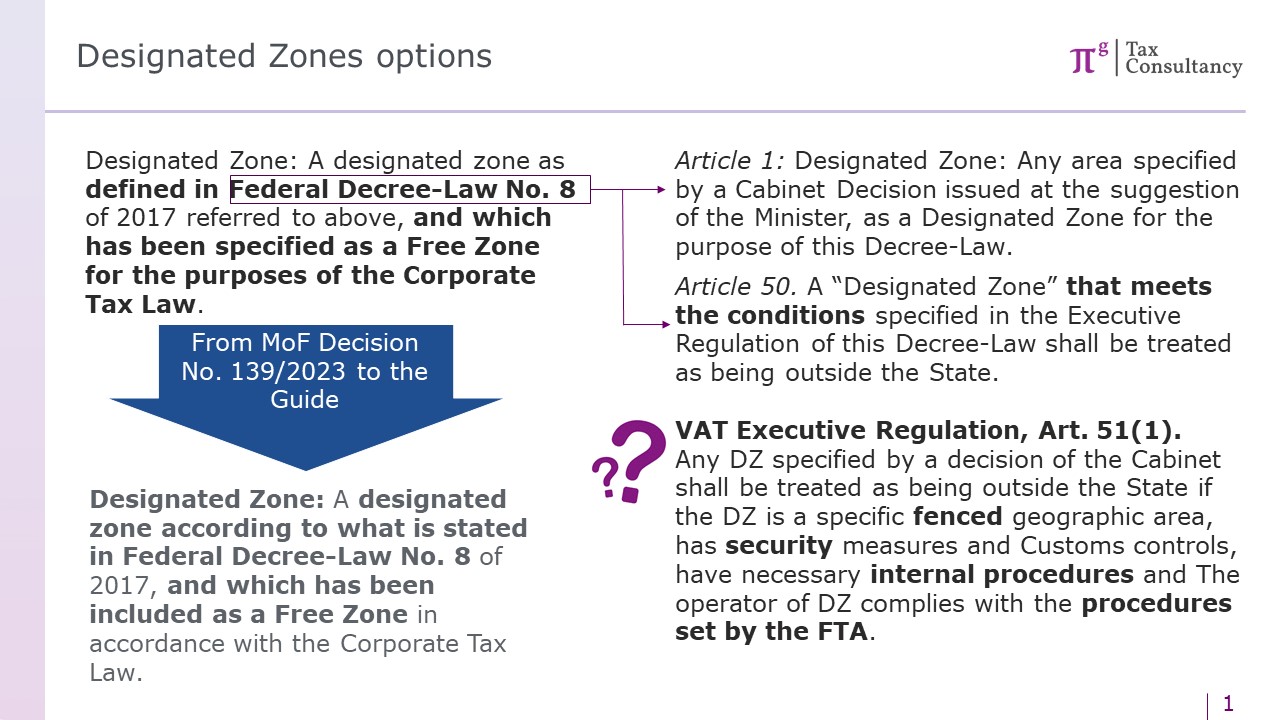

Its definition was introduced by Ministerial Decision No. 139 of June 1, 2023. On October 27, the MoF replaced this decision with Decision No. 265. The latter does not include the definition of a Designated Zone (DZ). The replacement is effective from June 1. Up to the moment when the Guide for Free Zone Persons was released in May 2024, there had been no special definition for DZ for CT purposes. The Guide defined it as ‘a designated zone according to what is stated in Federal Decree-Law No. 8 of 2017, and which has been included as a Free Zone in accordance with the Corporate Tax Law’.

The slide addresses three questions:

- May a Zone which is not Designated for VAT, e.g. ADGM or DIFC, be recognized as Designated for CT purposes?

- May a Zone, which is recognized as DZ for VAT and a Free Zone for CT, be treated as DZ for VAT only. In other words, is confirmation that a zone is Designated for CT required in addition with confirmation that such a Zone is a Free Zone or does confirmation of CT Free Zone suffice?

- What if a zone is included in the Cabinet’s list of VAT Designated Zones but is not compliant with the conditions given by the

Cabinet to be treated as located outside of the UAE for VAT purposes? If recognized as a Free Zone for CT, should such a zone be treated as Designated or not? The answer to the 1st question is ‘No’. To fit the above definition of a DZ, the Zone shall comply with two conditions:

• to be recognized as a DZ for VAT, and

• to be recognized as a FZ for CT.

Consequently, the answer to the 2nd question is also ‘Negative’. If a VAT Designated Zone is recognized as a Free Zone for CT, it automatically shall be treated as a DZ for both. The rationale for such an answer is that all facts to apply the definition rule are in place and there is no subject for additional confirmation.

The answer to the 3rd question requires more details. The compliance with ‘out of State’ status is not required to be treated as a DZ neither for VAT nor for CT. Indeed, the FZ Persons Guide refers to the DZ defined so under VAT Law. VAT Law defines it as ‘any area specified by a Cabinet Decision … as a Designated Zone for the purpose of this Decree-Law’. Article 50 of VAT Law breaks done all DZ into two categories: those which shall be ‘treated as out of State’ and in-State Designated Zones. The Cabinet determines the rules to be met by the first Category. The definition of DZ for CT refers to the Designated Zones under VAT Law rather than to the ‘out of State’ Designated Zones. Hence, both above categories (in-State and out-of-State) meets this definition.