The UAE Tax Case Study. Ancillary of incidental: effect for the UAE Corporate Tax

This Monday, we published the slides related to the definition of Ancillary Activities. In the attached slide, we delve into differentiating between Ancillary and Incidental Activities.

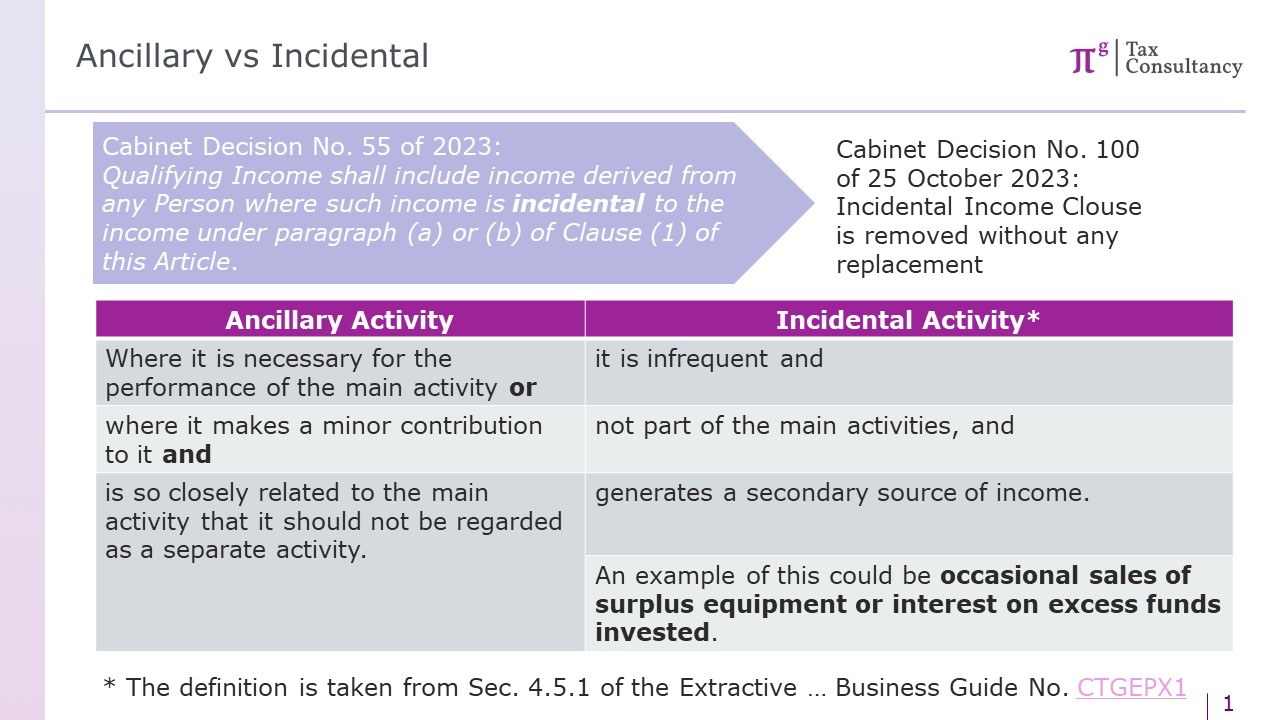

I watched a webinar held by a prominent local tax consultancy firm where these terms were used interchangeably. However, they should not be treated as equal since Incidental Income is no longer Qualifying Income for the 0% Corporate Tax rate.

As you may see on the slide, the Cabinet qualified Incidental income in Decision No. 55/2023, and the Minister qualified Ancillary Activities in Decision No. 139/2023. Therefore, there was no special need to differentiate between them, as both were qualifying for the 0% Corporate Tax rate. However, in October 2023, Decision No. 55 was repealed and replaced by Decision No. 100, which omits the rule on the qualification of Incidental income.

In the Free Zone Persons Guide, the FTA doesn’t provide a special rule but, in its examples, disqualifies incomes from Incidental Activities. You may find these activities in the examples of Incidental Income in the Extractive Business Guide (as allowed to be exempt) and in the Free Zone Guide as not allowed for the 0% tax rate.

The difference in their definitions is vague and conditional. They have much in common, especially Incidental Activity and the type of Ancillary Activity with minor input to the main Activity.

Generally, both activities feature:

1) Supplementary nature, i.e. both types of activities serve to support or enhance the main activity of a business or operation.

2) Non-Primary Focus. Neither are the primary focus of the business.

3) Complementary Role. They are generally designed to complement the primary business operations.

To distinguish between them, one should consider the following:

- Incidental Activities are activities that occur as a by-product or secondary outcome of the primary business activities. They are not essential but happen naturally in the course of business.

- In terms of intent and necessity, Ancillary Activities are generally planned for the main activity to be carried out efficiently whereas Incidental Activities are not necessarily planned and often arise spontaneously.

- In terms of frequency, Ancillary Activities are usually conducted on permanent or at least frequent basis but Incidental Activities are not frequent.

- In terms of resource allocation, if specific resources are allocated to the activity, it is most probably an ancillary one. If it uses resources incidentally, it is obviously incidental.